|

xTuple ERP Reference Guide |

Sales categories are used to identify the general ledger (G/L) accounts to be used when processing the following:

Non-inventory invoices

Receivables credit memos (optional)

Receivables debit memos (optional)

Cash receipts (optional)

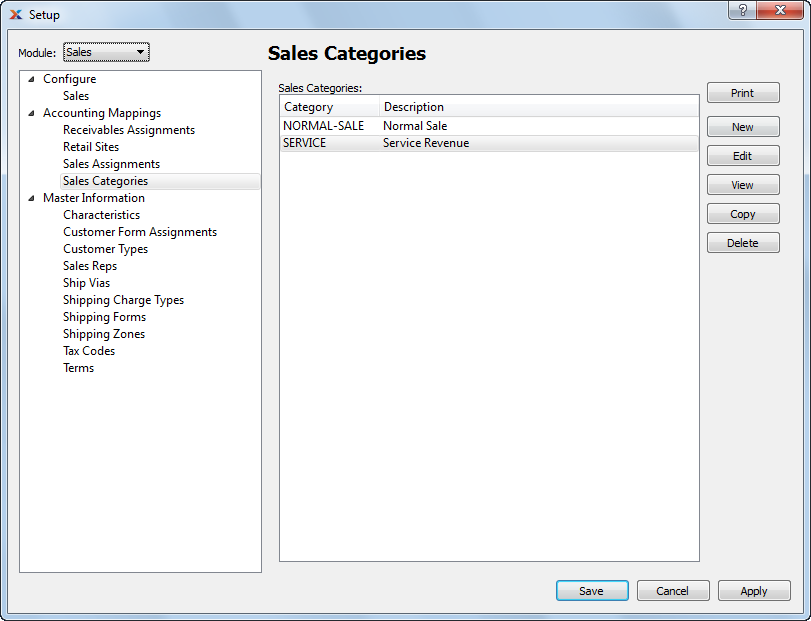

For example, when creating an invoice for miscellaneous goods or services unrelated to inventory, you must select a sales category—thereby identifying the G/L accounts the sales transaction will be distributed to. To access the Sales Categories master list, go to . The following screen will appear:

The Sales Categories screen displays information on existing sales categories.

To create a new sales category, select the button. The following screen will appear:

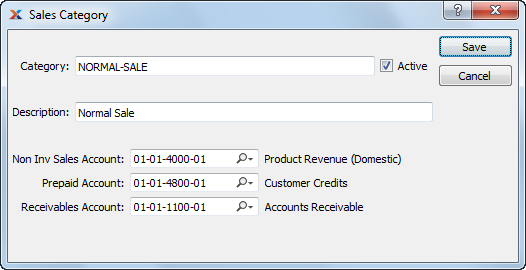

When creating a new sales category, you are presented with the following options:

Enter an identifying code for the sales category.

Select if the sales category is currently active. Not selecting means the sales category is inactive.

Enter a description to identify the sales category.

Identify a general ledger (G/L) account to distribute sales revenue to for non-inventory items. This is a revenue account. It will be credited when invoices for non-inventory goods are posted.

Specify a G/L account to use for handling prepaid receivables. This is a revenue contra account. If a sales category is used when entering a miscellaneous receivables credit memo, this account will be debited when the credit memo is posted. If used when entering a miscellaneous receivables debit memo, the account will be credited when the debit memos are posted.

Specify a G/L account to use for handling customer deposits. This is an asset account. If a sales category is used when applying a cash receipt to a customer invoice, this account will be credited when the cash receipt is posted.