|

xTuple ERP Reference Guide |

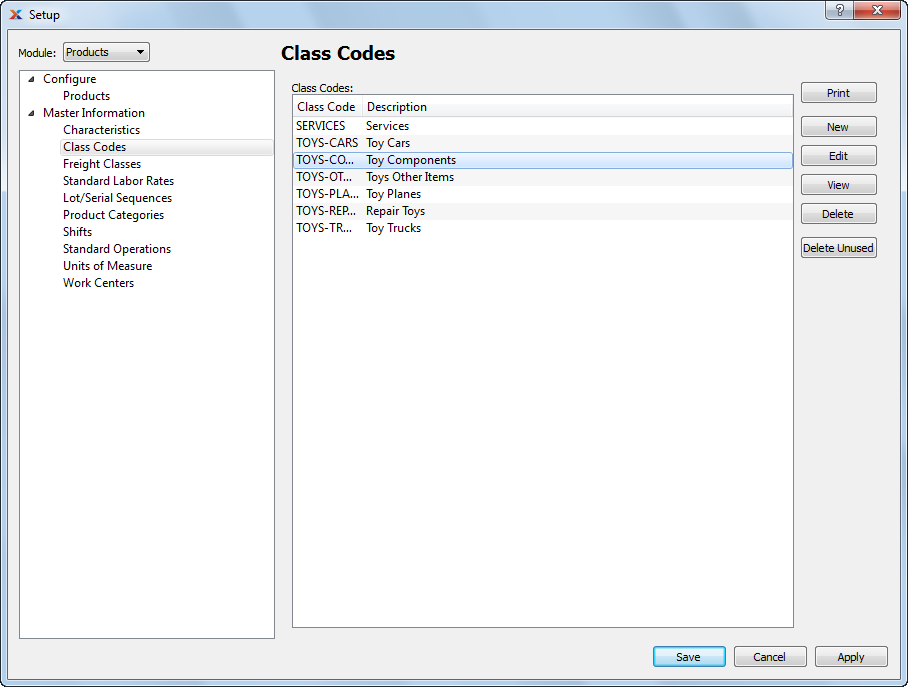

Specifically used for inventory control, class codes provide a mechanism for categorizing items regardless of item type. To access the master list of class codes, go to . The following screen will appear.

The Class Codes screen displays information on all existing class codes, including class code and class code description.

The following buttons are unique to this screen:

Select to delete all unused class codes.

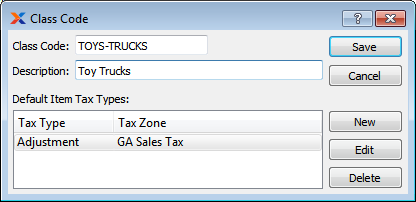

To create a new class code, select the button. The following screen will appear:

Create your class codes using a logical, hierarchical structure. This will make it easier to retrieve class code information in the future.

When creating a new class code, you are presented with the following options:

Enter a unique code to identify the class code.

Enter a description to further identify the class code.

Lists the tax zone defaults for different tax types.

When you create a default item tax type, this will be the tax type that will be automatically assigned to a newly created item. Items that have already been created and are in the database will not have their tax types changed even if you edit the default. To create a default tax type, select the button. The following screen will appear:

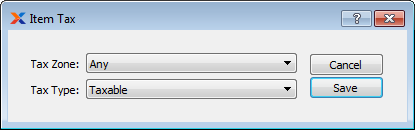

When creating a new item tax type default, you are presented with the following options:

Specify the tax zone you want to associate with the specified tax type. Creating a relationship between a tax zone and a tax type enables you to determine how tax will be applied when processing transactions using the item. If you select the Any option, this means any defined tax zone is a possible match.

Consider creating separate tax types for any groups or classes of items which are taxed at different rates.

Specify the tax type you want to associate with the specified tax zone. Tax types provide a system for classifying goods and services into taxable categories. Creating a relationship between a tax zone and a tax type enables you to determine how tax will be applied when processing transactions using the item. If you select the Any option, this means any defined tax type is a possible match.