|

xTuple ERP Reference Guide |

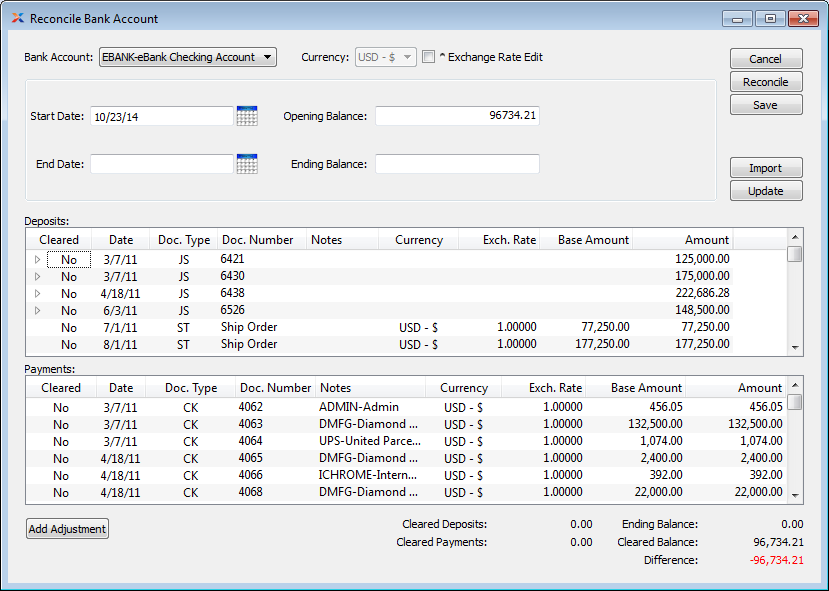

To reconcile a bank account, go to . The following screen will appear:

To reopen a posted bank reconciliation, go to the Summarized Bank Reconciliation History screen and right-click on the most recently posted reconciliation. Only the most recently posted bank reconciliation can be reopened.

When reconciling a bank account, you are presented with the following options:

Specify the bank account you want to reconcile.

Displays the currency of the selected bank account. To help with the reconciliation of foreign currency transactions, the screen allows you to edit the exchange rate for specific transactions. Simply click on the Exchange Rate field for a given record to edit the exchange rate for that record. Once the rate has been edited, double-click on the row to save the changes. This feature is designed to help you reconcile your bank accounts only and does not have any impact on the general ledger or your global exchange rates.

Select if you want the ability to edit the exchange rate for any posted deposits or payments. Editing exchange rates for bank reconciliation purposes does not impact the general ledger. When this option is selected, simply double-click on a record to edit its exchange rate—then select the button to finalize the edit. You must select the button for the new exchange rate to be recognized. If this option is not selected, you may not edit exchange rates. When cash-based tax distribution is used, this field is called Exchange Rate/Effective Date Edit and double-clicking a record will enable you to change the effective date as well as the exchange rate.

To work on a bank reconciliation over several sessions, simply select the button. Your work will be saved and ready when you return.

By default the start date field will be pre-populated based on the end date of your most recent bank reconciliation—if it exists. The date used will be one day after the previous bank reconciliation end date. If you want to use a different start date, simply edit the date to your preferred date. Keep in mind that once a date range has been reconciled, it's not possible to re-reconcile the same range twice. You must select new date range.

Specify the ending date of the current bank reconciliation period. Bank reconciliations are identified by their date ranges, for reporting purposes. Keep in mind that once a date range has been reconciled, it's not possible to re-reconcile the same range twice. You must select new date range.

By default the Opening Balance field will be pre-populated with the ending balance of your most recent bank reconciliation—if it exists. If you want to use a different opening balance, simply edit the amount to your preferred amount.

Enter the current ending balance, as shown on your bank statement.

Display lists posted receipts and other deposits which have not been previously reconciled. This display is a nested list, with a plus sign () located to the far left of the display next to each receipt or deposit that may be expanded to lower levels. By clicking your mouse on a plus sign, you reveal lower levels of information related to the group. Double-click on a deposit line to mark the document as cleared and to save any edits made to the exchange rate.

Cash receipts posted in batch mode will appear grouped together in the nested list appearing under the appropriate document number.

Display lists posted checks and other payments which have not been previously reconciled. Double-click on a payment line to mark the document as cleared and to save any edits made to the exchange rate.

Select to add a bank adjustment directly to either the deposits or payments list. Bank adjustments marked as cleared will automatically be posted to the general ledger (G/L) when a bank account is reconciled. For more information on entering bank adjustments, see Section 4.2, “Bank Adjustment”.

Displays a running total amount of deposits which have been marked as cleared. Double-click on a document using your mouse to mark the document as cleared. To unmark the document, double-click on it again. The Cleared column value will alternate between Yes and No as you double-click on a document line.

Displays a running total amount of payments which have been marked as cleared. Double-click on a document using your mouse to mark the document as cleared. To unmark the document, double-click on it again. The Cleared column value will alternate between Yes and No as you double-click on a document line.

Displays the ending balance entered in the Ending Balance field.

Displays the cleared balance. The cleared balance is calculated based on the following formula:

(Opening Balance) + (Cleared Deposits) - (Cleared Payments)

A successful bank reconciliation will result in the cleared balance being equal to the ending balance.

Displays the difference between the ending balance and the cleared balance. A successful bank reconciliation will result in having 0.00 displayed as the amount of difference between the two balances.

The following buttons are unique to this screen:

If you want to save any work you have done in the current or a prior session, you should select the button. Selecting can cause your saved information to be cleared. The next time you open the Bank Reconciliation screen, the work you saved previously will be ready for you to start working on it again.

Select to reconcile the specified bank account and create a record of the bank reconciliation. Selecting this option posts the bank reconciliation. The posting may be viewed using the Bank Reconciliation History display. The start and end dates for the posting are used to identify it.

Once a bank account is reconciled, any deposits or payments which were marked as cleared will no longer be available for future bank reconciliations.

Select to import a bank statement file in .CSV format. This button will be hidden if you have not configured the system to allow the importing of bank records. When you select this button, the Import Data screen will be launched using the specified bank account and period being reconciled. You will then follow the instructions in the Import Data screen to complete the import. The data import program will attempt to match bank entries with existing records based on check numbers, dates, and amounts. During this process, you will be able to manually associate any bank records that did not find a match. You will also be able to manually disassociate mis-matched entries. In addition, you may convert any unmatched entry into a manual bank adjustment, miscellaneous check, or journal entry. Color coding is used to indicate cleared records associated with matched bank account imports (i.e., the color green = matched).

Select to update the Bank Reconciliation screen with any new transaction information not already listed.