|

xTuple ERP Reference Guide |

The system ships with a basic income statement designed to generate financial reports using your revenue and expense account data. In this section, we will examine this basic income statement.

Because the basic income statement is a system-defined financial report, it may not be modified (except to make it active or inactive). However, you may copy the report and modify the copy. You can think of the basic income statement as a template for building other, similar financial reports.

If the xTuple Project Accounting package is installed, the basic income statement will be available to projects.

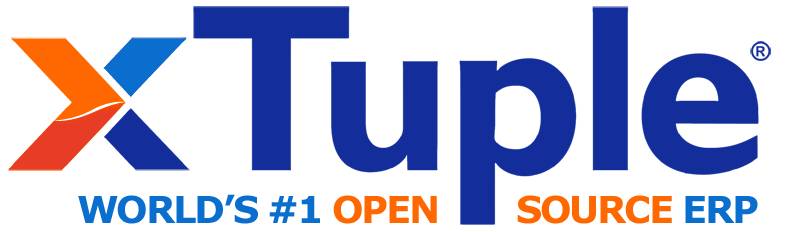

To view the basic income statement, select it for editing from the master list of financial reports. A message will alert you that this is a system-defined report which may only be viewed, not edited. Select the button to reach the following screen:

The tab displays information on all the account groups and account numbers which make up the basic income statement. If this were a custom report you were creating, you would be able to add/remove account groups and account numbers to meet your specific needs.

To build row layouts for the three standard report types—income statement, balance sheet, and cash flow—use the same techniques as when building ad hoc report row layouts. The only difference is you won't need to specify which balances to calculate (e.g., beginning, ending, etc.). The system determines which calculations will be done for the standard statement formats.

When viewing row layouts for the basic income statement, you are presented with the following columns:

Group/Account Name: Lists the account groups and account types used in the report. The two main groups are REVENUE and EXPENSES. All accounts having Type=Revenue are included in the REVENUE group. And within the EXPENSES group all accounts having Type=Expense are included.

Sub./Summ.: Indicates whether group information will be presented as a subtotal or summary line when the report is run. In the basic income statement, all account groups are subtotaled.

Oper.: Specifies whether a group will be added to () or subtracted from () the group total. In the basic income statement, REVENUE is added to and EXPENSES are subtracted from the INCOME group.

Select the button to see the system-defined settings for each account group and account type used in the basic income statement. When creating your own reports, you may choose to either imitate or alter these default settings.

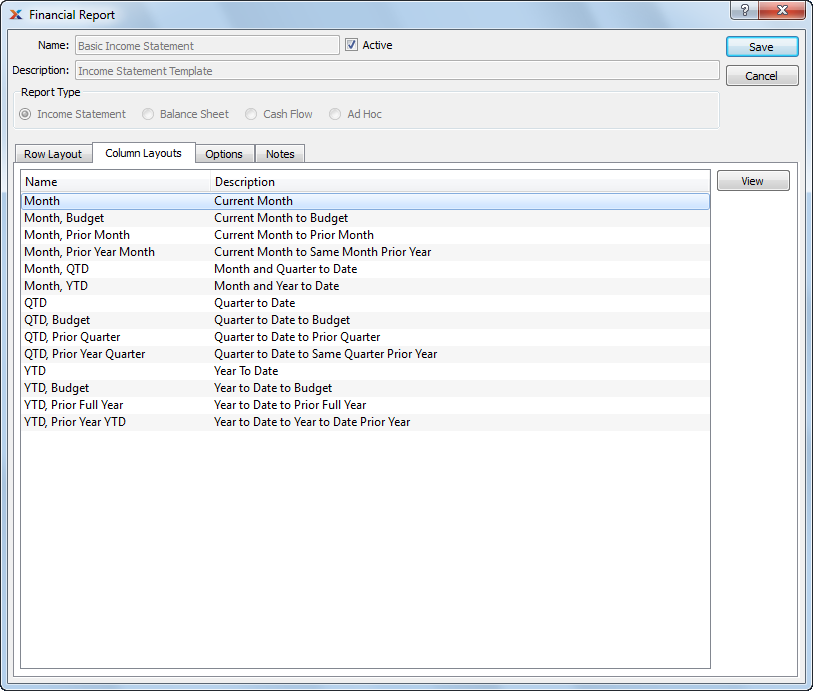

In addition to row layouts, you may also define column layouts for your financial reports. Column layouts are used to specify the time buckets financial information will be sorted into. You specify a column layout to use when viewing or printing financial reports. You may define any number of column layouts. Each layout will be linked to either a pre-defined report definition or a custom report definition you create yourself.

On the basic income statement, select the tab to view all the time buckets available for the report. If this were a custom report you were creating, you would be able to add/remove column layouts to meet your specific needs.

See Section 6.1.3, “ Cash Flow Report” for specific examples describing the various column layout options.

When viewing column layouts for the basic income statement, you are presented with the following column definitions—each of which defines a different time bucket available for viewing income statement information:

Month: Displays data for the current month (i.e., accounting period). The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportMonth report definition.

Month, Budget: Displays data for the current month, compared to budget information for the current month. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportMonthBudget report definition.

Month, Prior Month: Displays data for the current month, compared to the prior month. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportMonthPriorMonth report definition.

Month, Prior Year Month: Displays data for the current month, compared to the same month in the prior fiscal year. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportMonthPriorMonth report definition.

Month, QTD: Displays data for the current month, compared to the current quarter to-date. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportMonthQuarter report definition.

Month, YTD: Displays data for the current month, compared to the current fiscal year to-date. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportMonthYear report definition.

QTD: Displays data for the current quarter to-date. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportQuarter report definition.

QTD, Budget: Displays data for the current quarter to-date, compared to budget information for the current quarter. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportQuarterBudget report definition.

QTD, Prior Quarter: Displays data for the current quarter to-date, compared to the prior quarter. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportQuarterPriorQuarter report definition.

QTD, Prior Year Quarter: Displays data for the current quarter to-date, compared to the same quarter in the prior fiscal year. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportQuarterPriorQuarter report definition.

YTD: Displays data for the current fiscal year to-date. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportYear report definition.

YTD, Budget: Displays data for the current fiscal year to-date, compared to budget information for the current fiscal year to-date. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportYearBudget report definition.

YTD, Prior Full Year: Displays data for the current fiscal year to-date, compared to information for the entire prior fiscal year. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportYearPriorYear report definition.

YTD, Prior Year YTD: Displays data for the current fiscal year to-date, compared to the prior fiscal year to-date. The month used as the basis for the reporting is specified when the report is run. Uses the FinancialReportYearPriorYear report definition.

Select the button to see the system-defined settings for each account group and account type used in the basic income statement. When creating your own reports, you may choose to either imitate or alter these default settings.

When creating a column layout, you can choose from the following standard report templates:

FinancialReport (used by all ad hoc reports)

FinancialReportMonth

FinancialReportMonthBudget

FinancialReportMonthDbCr

FinancialReportMonthPriorMonth

FinancialReportMonthPriorQuarter

FinancialReportMonthPriorYear

FinancialReportMonthQuarter

FinancialReportMonthYear

FinancialReportQuarter

FinancialReportQuarterBudget

FinancialReportQuarterPriorQuarter

FinancialReportYear

FinancialReportYearBudget

FinancialReportYearPriorYear

FinancialTrend (used by non-ad-hoc trend reports)

If for some reason these templates don't meet your needs, you can always use OpenRPT to a) modify them or b) create your own custom report templates.

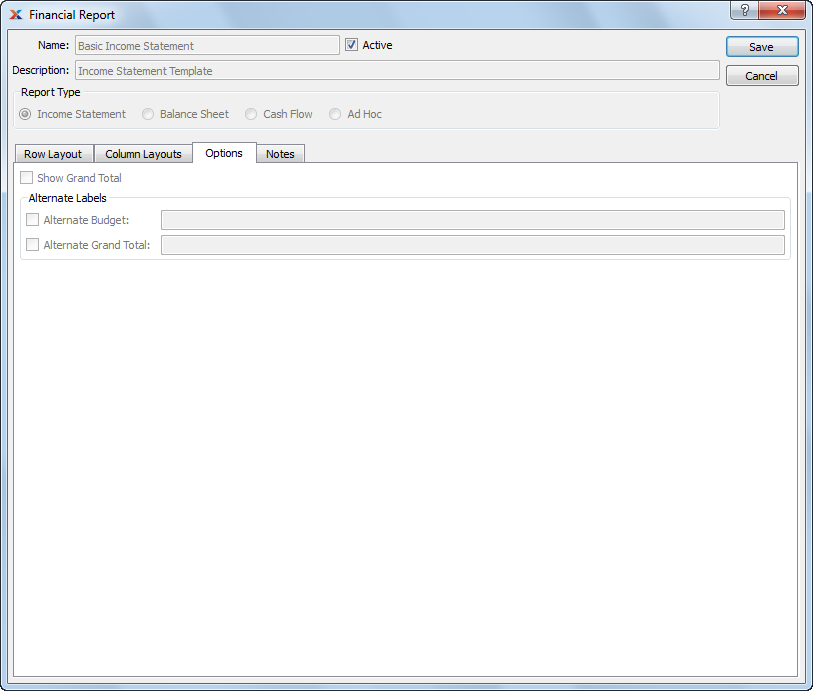

To view additional configuration options for the layout of the basic income statement, select the tab. The following screen will appear:

The layout for the basic income statement does not use any extra configuration options. However, if you were creating your own income statement layout, you could choose to a) include a grand total row and b) use alternate labels for budget and grand total rows when viewing and/or printing the financial report.

Any notes you add to a financial report definition will appear at the bottom of the financial report when the financial report is printed.