|

xTuple ERP Reference Guide |

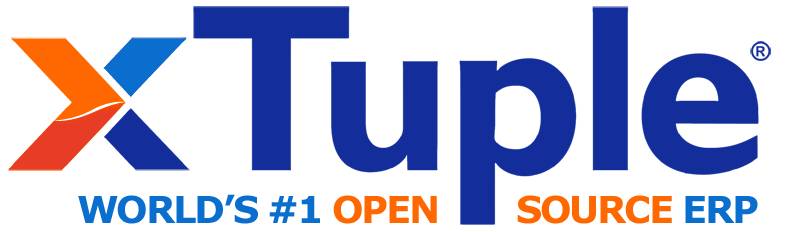

To enter a miscellaneous credit memo, go to . The following screen will appear:

Miscellaneous receivables credit memos can be applied to invoices or miscellaneous receivables debit memos.

When entering a miscellaneous credit memo, you are presented with the following options:

Enter the customer number of the customer you want to enter a miscellaneous credit memo for. The lookup feature located to the right of the field leads to a searchable customers list. You may also access this list using the keyboard shortcut . Once a customer number is entered, the customer name and billing address will display. Select the or symbol to view customer information for the specified customer. If a customer's credit is good, the button will feature a black question mark () icon. If the customer is on credit warning, the icon will turn into an orange dollar sign (). A red dollar sign () indicates the customer is on credit hold.

Specify a date to associate with the miscellaneous credit memo.

Displays the due date for the miscellaneous credit memo.

Displays the document type, namely Credit Memo.

Displays the next available miscellaneous credit memo number. The value for the next available credit memo number is configured at the system level.

Enter the order number you want to associate with the credit memo. You may leave this field blank if you do not want to enter an associated order number.

Displays the journal number if any amount has been applied.

Specify the reason for the credit memo. Reason codes are used to explain why an adjustment is being made to a customer's account.

Displays invoice terms if any amount has been applied to an invoice.

Displays the sales representative associated with the invoice if any amount has been applied to an invoice.

Specify the amount of the miscellaneous credit memo.

Displays the amount applied to date for the miscellaneous credit memo.

Displays the remaining amount still available to apply for the miscellaneous credit memo.

Displays the tax zone associated with the specified customer.

Tax will be calculated automatically if the associated tax code is configured to calculate tax on memos. You can link a tax code to memos with a tax assignment that matches the tax code, the tax zone, and the system-defined Adjustment tax type. To manually enter tax, select the blue link which serves as the label for this field. If tax is entered manually, the amount will be charged to the general ledger account for the relevant tax code.

Displays the amount of the commission due to the associated sales representative.

This is a scrolling text field with word-wrapping for entering notes related to the miscellaneous credit memo. Notes entered on this screen will follow the credit memo through the billing process. For example, you may view notes associated with a posted credit memo within the customer history report.

Select if you want to print a copy of the credit memo after the button is selected. Credit memos may also be reprinted from, among other places, the Customer screen.

If the customer specified on the credit memo has an EDI profile attached, you may encounter an EDI processing interface when printing it.

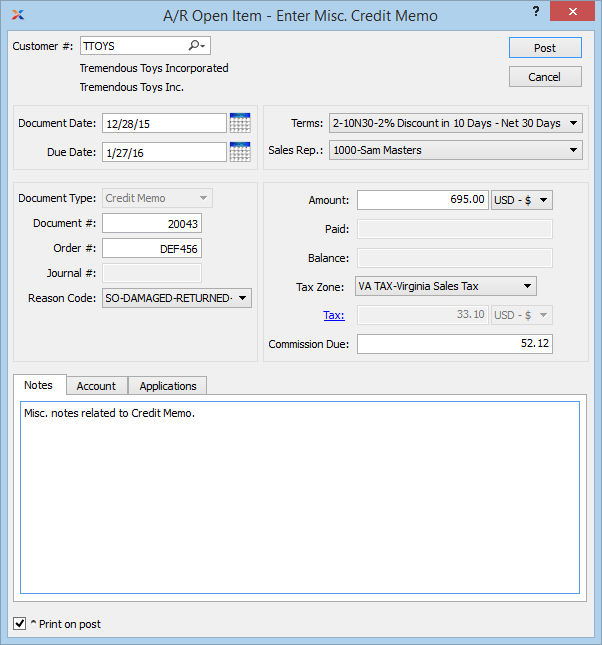

To assign an alternate prepaid account, select the tab at the bottom of the screen. The following screen will appear:

If an alternate prepaid account is not specified, the system will use the default prepaid account specified for the customer type under receivables account assignments.

Select one of the following optional prepaid accounts:

Specify a sales category whose prepaid account option you want to use instead of the default prepaid account.

Specify an alternate account number to use for the transaction.

If an alternate prepaid account is not specified, the system will use the default prepaid account specified for the customer type under receivables account assignments.

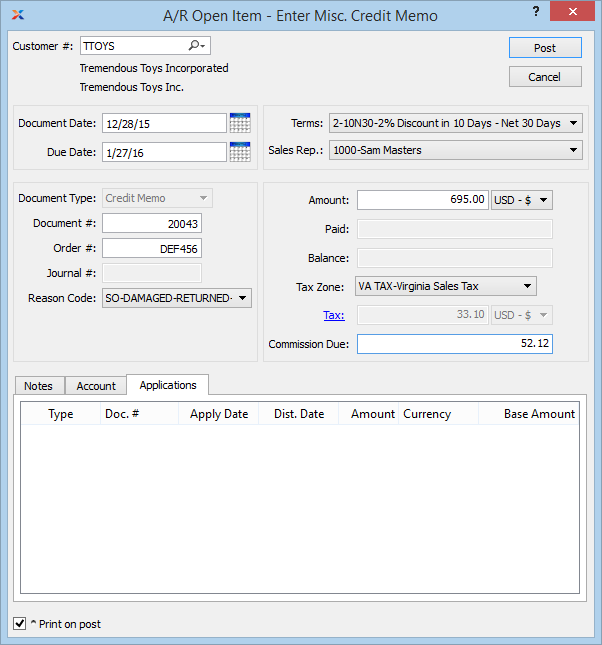

To view applications, select the tab at the bottom of the screen. The following screen will appear:

Display lists the history of applications related to the miscellaneous credit memo, if any.