|

xTuple ERP Reference Guide |

Expense categories are used to identify the general ledger (G/L) accounts to be used when processing the following:

Non-inventory purchase order items

Miscellaneous vouchers

Miscellaneous payables checks

Expense transactions

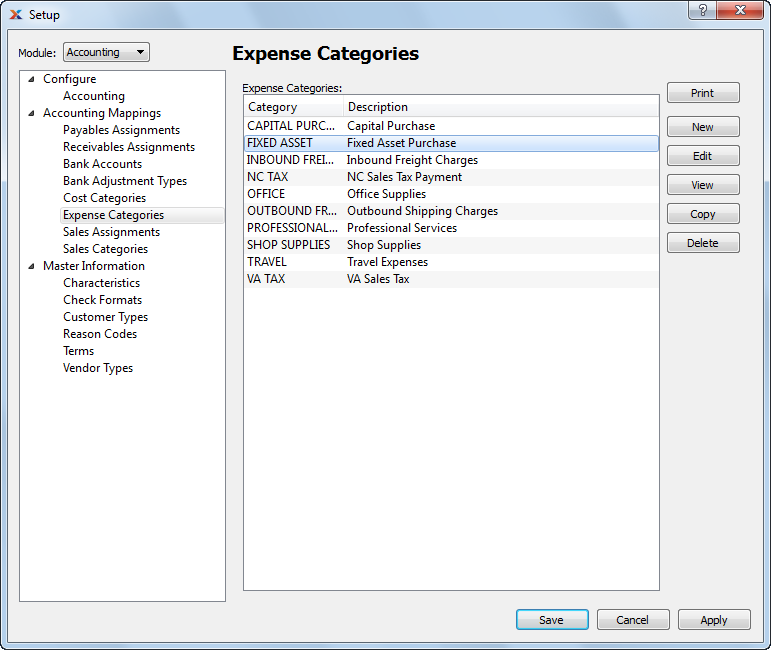

For example, when entering a purchase order for a non-inventory item, you must select an expense category—thereby identifying the G/L accounts the purchasing transaction will be distributed to. To access the master list of expense categories, go to . The following screen will appear:

The Expense Categories screen displays information on all existing expense categories, including expense category code and expense category description.

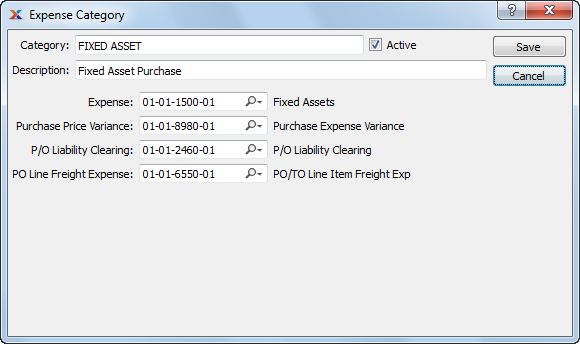

To create a new expense category, select the button. The following screen will appear:

When creating a new expense category, you are presented with the following options:

The account numbers assigned to cost categories should not all be the inventory account. Instead, they should be individual accounts selected specifically for each cost-tracking purpose. This will increase your visibility into your inventory costs and valuation.

Enter the expense category name.

Enter a brief description of the expense category.

Select to show the expense category as active. Not selecting means the expense category will be considered inactive. To re-activate an expense category, simply select this option.

Identify a general ledger (G/L) account to distribute purchasing expenses to. This is an expense account. It will be debited when transactions using expense categories are posted.

Identify a G/L account to distribute purchase price variances to. This is an asset account. It will be credited or debited with the value of any variance that may arise when a voucher is posted for non-inventory items.

Identify a G/L account to distribute purchase order liability clearing to. This is a liability account. It will be credited when non-inventory items are received, and debited when a voucher for these items is posted.

Identify a G/L account to distribute freight expense to. This is an expense account. It will be debited when line freight expenses are posted.