|

xTuple ERP Reference Guide |

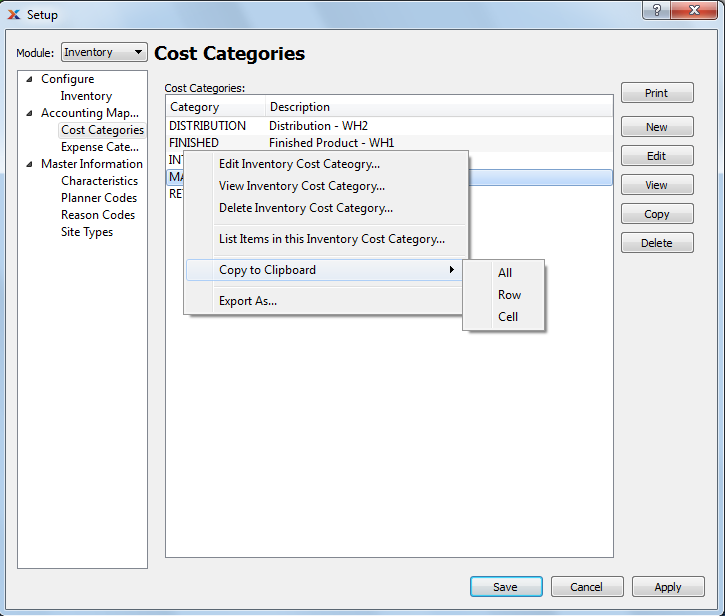

Cost categories are applied to item sites as a mechanism for specifying how costs should be distributed to the general ledger whenever inventory is received, moved, consumed, produced, shipped, scrapped, or returned. To access the master list of cost categories, go to . The following screen will appear:

Cost categories define cost distributions for inventory items. The distribution of costs for non-inventory items are determined by expense categories.

The Cost Categories screen displays information on all existing cost categories, including cost category code and cost category description.

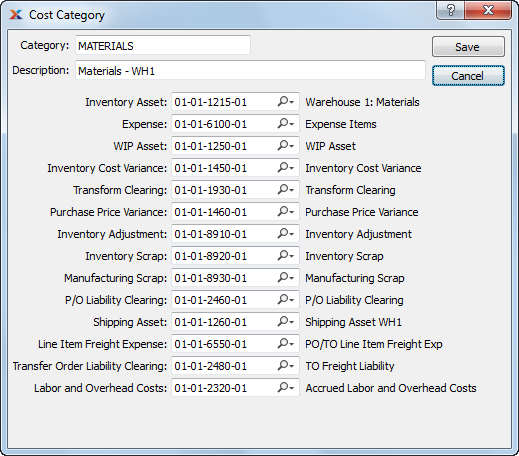

To create a new cost category, select the button. The following screen will appear:

When creating a new cost category, you are presented with the following options:

By default, the screen will limit your account number choices to only those accounts having the correct account type for the chosen context. However, privileged users may override this default behavior by manually entering any account number listed in the chart of accounts.

Enter the cost category name.

Enter a brief description of the cost category.

The account numbers assigned to cost categories should not all be the inventory account. Instead, they should be individual accounts selected specifically for each cost-tracking purpose. This will increase your visibility into your inventory costs and valuation.

Identify a general ledger (G/L) account to distribute inventory assets to. This is an asset account. It will be debited when inventory is received and credited whenever inventory items are removed from inventory.

Identify a G/L account to be used for expensing purchase receipts for items having a control method of None. This is an expense account. It will be debited when non-inventory purchase receipts are posted.

Identify a G/L account to distribute work-in-process (WIP) assets to. This is an asset account. It will be credited and/or debited with labor, material, and overhead costs while a work order is in-process. The sense of the transaction record depends on the circumstances of the transaction.

Identify a G/L account to distribute inventory cost variances to. This is an asset account. It is used in several scenarios: 1) If there is a difference between new actual cost and old standard cost when posting actual costs to standard; 2) During work order processing if too many materials are issued to a work order, or if a work order is closed without the full quantity being posted. The sense of the transaction record depends on the circumstances of the transaction.

Identify a G/L account to distribute transform transactions to. This is an asset account. It will be credited when a source item quantity is transformed, and debited for an equal amount when the target item quantity is received into inventory.

Identify a G/L account to distribute purchase price variances to. This is an asset account. It will be credited or debited with the value of any variance that may arise when a voucher is posted. The sense of the transaction record depends on the circumstances of the transaction.

Identify a G/L account to distribute inventory adjustments to. This is an expense account. It will be credited or debited with the value of any variance that may arise when a miscellaneous adjustment transaction or count tag transaction is posted against an item. The sense of the transaction record depends on the circumstances of the transaction.

Identify a G/L account to distribute inventory scrap to. This is an expense account. It will be credited when a scrap transaction is posted against an item.

Identify a G/L account to distribute manufacturing scrap to. This is an expense account. It will be credited when work order material requirements are scrapped from a work order.

Identify a G/L account to distribute purchase order liability clearing to. This is a liability account. It will be credited when a purchase order receipt is posted and debited when a voucher is posted.

Identify a G/L account to distribute shipping assets to. This is an asset account. It will be debited with the standard cost of a sales order item when the item is issued to shipping and credited once the item has been shipped.

Identify a G/L account to distribute purchase order or transfer order line item freight expenses to. This is an expense account. It will be debited when purchase order or transfer order line items are received. The account may be debited or credited when correcting purchase order receipts.

Identify a G/L account to distribute transfer order liability clearing to. This is a liability account. It is used for recognizing liability related to transportation costs related to transfer orders. It will be credited when transfer orders receipts having freight charges are posted. It should be debited when the freight (or other vendor) is paid by miscellaneous check.

Overhead costs: Identify a G/L account to distribute labor and overhead costs to. This is a liability account. It will be debited and/or credited with labor and overhead costs when work orders are in-process or posted. The sense of the transaction record depends on the circumstances of the transaction.