|

xTuple ERP Reference Guide |

If you need to track and report on account activity for multiple companies—or if you are consolidating external companies into your parent xTuple database—then you will need to define company information on this screen. To prevent unbalanced trial balances at the company level, G/L transactions and series postings will not be allowed that cross companies.

If prior to xTuple ERP 3.7.0 you were using the company segment for something other than separate company reporting—and you need to continue that usage—please contact your xTuple support representative.

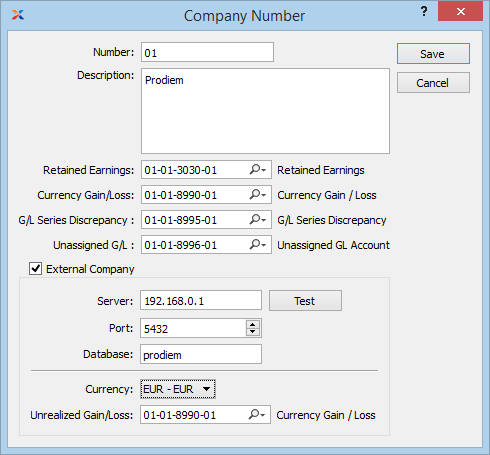

To add a new company, select the button. The following screen will appear:

When creating a new company, you are presented with the following options:

Enter a number to identify the company.

Enter a brief description of the company.

Select a valid general ledger account. This is an equity account. It will be credited if retained earnings are positive—and debited if retained earnings are negative. The retained earnings calculation occurs when a fiscal year is closed. Total expenses for the year are subtracted from total revenues, and the balance is transferred to the year end equity account. The system then automatically resets the beginning balances for revenue and expense accounts to $0 for the start of the new fiscal year.

Select a valid general ledger account. This is an expense account only needed for xTuple ERP databases where multiple currencies are in use. The account will debited for currency gains and credited for currency losses arising from fluctuating exchange rates. Currency gains/losses may be recognized at the following points: 1) When posting a cash receipt applied to an invoice; 2) when posting a payables check applied to a voucher; 3) when applying a receivable misc. Credit memo to an invoice; and 4) when applying a payables misc. Credit memo to a voucher. In each case, the gain or loss arises when the exchange rate used for the apply-to document differs from the exchange rate used for the application.

Select a valid general ledger account. This is an expense account. It will be debited or credited if rounding errors cause discrepancies when multiple line item (i.e., series) transactions are posted to the general ledger. If used, the amounts posted to this account will be minuscule, as rounding errors are fractional by nature.

Select a valid general ledger account. This is a liability account. It will be debited or credited when the system cannot determine a ledger (or more typically a receivable/payable) account to distribute funds to. As a rule, there should be nothing in this account besides exceptions. The intention is that accountants should review the account monthly. If they find anything in the account, they should journal the amount out to the correct account(s) and fix the cause of the unassigned accounts.

Select to designate the company as a pointer to a company on another database. This option will only be visible if external company consolidation is enabled in the system's accounting configuration. This option is also available only on xTuple ERP Distribution Edition and higher.

Once G/L accounts have been created using a defined company segment, either manually or via synchronization, the External Company option will no longer be editable.

Enter the server address of the external company.

Enter the port used by the external company server.

Enter the database used by the external company.

Select to confirm the connection and external company compatibility criteria. This option will only be available once the connection details have been entered.

Specify the currency of the external company whose financial information you will be importing into the parent company database.

Specify a G/L account to be used for making corrections to your balance sheet due to currency fluctuations in or between accounting periods.