|

xTuple ERP Reference Guide |

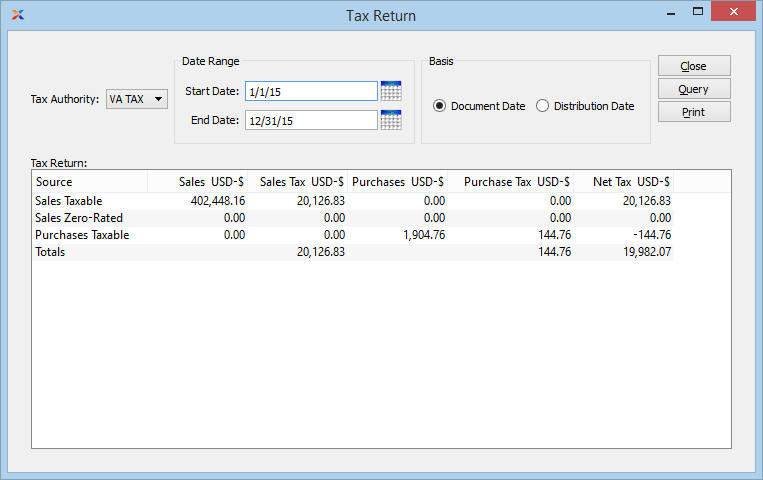

The tax return report provides a summarized listing of both taxable and zero-rated sales and purchases needed for reporting to tax authorities. The report is ideally suited to value added tax (VAT) scenarios, where tax liability is based on the difference between taxes paid on sales vs. taxes paid on purchases. To view the tax return report, go to . The following screen will appear:

When displaying a tax return, you are presented with the following options:

Specify the tax authority you want to display return information for. Display will summarize any sales or purchases where the tax code(s) used is specifically linked to the tax authority.

For transaction information to be included in the tax return report, the tax authority must be linked to one or more tax codes.

Specify the date range, based on the chosen date basis:

Taxes posted on and after this date will be included in the report.

Taxes posted on and before this date will be included in the report.

Specify a date basis to use for the report:

Select to use the document date as the basis for the report.

Select to use the G/L distribution date as the basis for the report.

Display lists summarized tax return information, using the specified parameters.

For detailed tax information, please see the Section 7.13, “Tax History” report.