|

Managing Projects with xTuple |

For the first example, let's look at an invoice which resulted from a time & expense sheet. As you may recall if you read the Time & Expenses chapter, invoices are created when processing time & expense sheets that are tied to a specific customer.

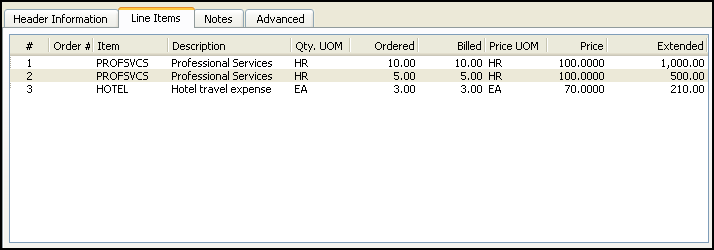

In the specific example we are looking at here, there are three line items: two for time billing and one for expense billing. All together, the three line items total $1,710 in billable charges.

We can't see it in the screenshot, but the invoice is linked to project "GREENLEAF". This is one of the projects you'll find in the xTuple demo database—and it's a project we've used in examples throughout this book. The link to project "GREENLEAF" was originally established on the time & expense sheet itself. A project link is required when creating time or expense entries. In that way, the documents which flow from approved and processed time & expense sheets (in this case an invoice) also inherit the project relationship.

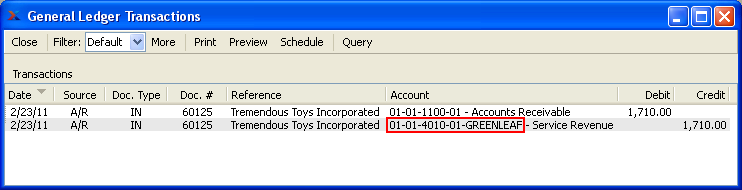

So, we now have an unposted invoice that is linked to project "GREENLEAF". Let's go ahead and post the invoice and examine the resulting G/L transactions:

In most respects, this G/L transaction is identical to any invoice posted using xTuple ERP. Just as with any posted Invoice, we have the following results:

Accounts receivable

Revenue account

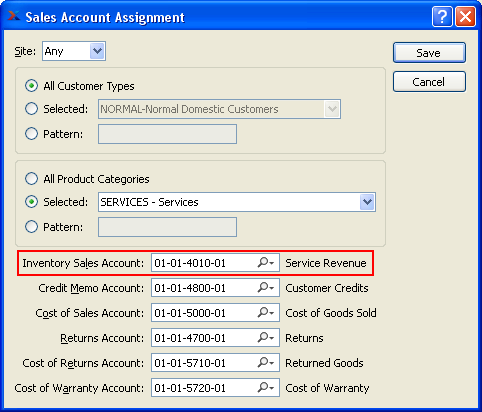

What makes this transaction different, though, is the project segment added to the end of the revenue account number. We've highlighted this account in the screenshot. It's account number 01-01-4010-01-GREENLEAF. This is an example of the virtual G/L accounts we've been talking about, made possible by project accounting. As we can see from the list of sales account assignments, the actual revenue account number is 01-01-4010-01:

With project accounting enabled, the system simply takes the normal revenue account that would be used when posting an invoice and adds the project number to it. The end result is a project-specific G/L transaction—all done dynamically on the fly. There is no additional setup required. When taken together, these project-specific transactions establish the basis for project financial reports. For example, you might want to look at income statements by project or cash flow statements by project, and so on. We will look at how to run financial reports by project later in this chapter.