|

Managing Projects with xTuple |

As we saw in the previous section, the CRM configuration allows you to define a G/L account used for tracking employee labor and overhead when time & expense sheets are posted. On the debit side of that transaction is an expense account:

Table 1.2. G/L transactions after posting employee time & expense sheets

| Debit | Credit |

| Reference item expense account | Project labor and overhead account |

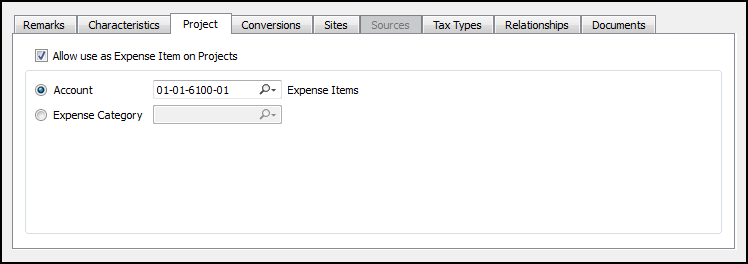

This expense account is defined at the item level—that is, on the Item masters for any reference type items you have defined in your system. The time & expense package adds a new tab to reference item records. And it is on this unique tab that you define the expense category (or G/L account) to be used for tracking expenses when time & expense sheets are posted.

As you can see in the screenshot, there is an option on the tab to Allow use as an Expense Item on Projects. You must select this option—and also define an expense category or account—for the item to be available to users who are entering time & expense sheets.

When users enter time & expense sheets they are required to select an item before they can save their time & expense sheet. Only reference items may be linked to time & expense sheets. Reference items are items which you sell—but you neither manufacture nor purchase. You also don't maintain them in inventory. Services are an example of reference items. You may sell consulting services, but you don't manufacture or purchase them.

Keep in mind, too, that time & expense sheets may be entered not only to track time but also expenses. When an expense entry on a time & expense sheet is converted to a voucher—and that voucher is then posted—the resulting G/L transaction uses the reference item expense account to record expenses:

Table 1.3. G/L transactions after posting T&E expense voucher

| Debit | Credit |

| Reference item expense account | Accounts payable |