|

xTuple ERP Reference Guide |

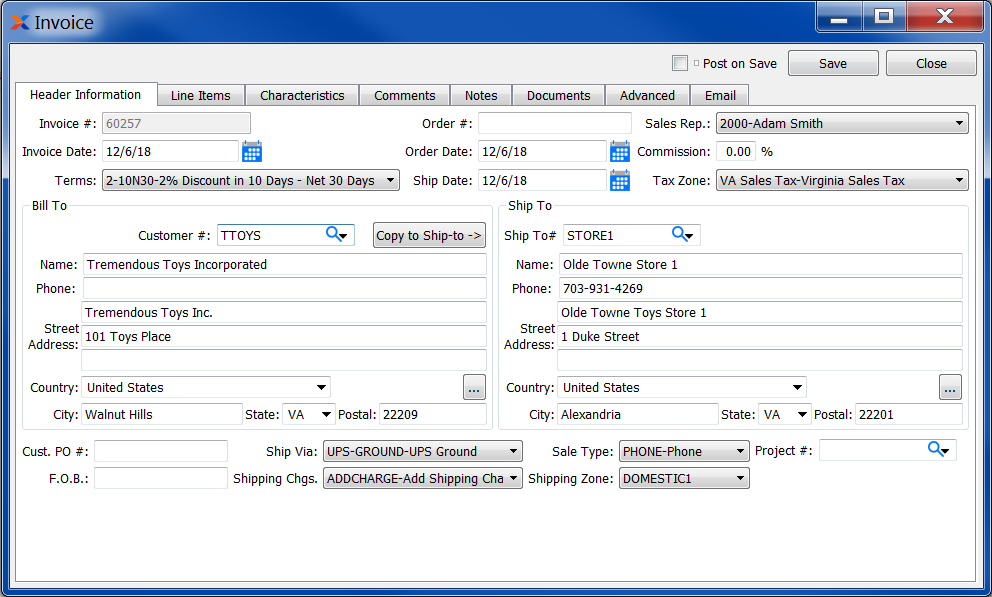

When you post a sales order that has been selected for billing, an invoice is created for that order. This is the standard flow for creating invoices tied to sales orders. However, you also have the option of creating miscellaneous invoices—that is, invoices which are not tied to sales orders. For example, you might use a miscellaneous invoice to bill for non-inventory items you have sold. To create a miscellaneous invoice, go to . The following screen will appear:

When creating an invoice, you are presented with the following options:

Next available invoice number will automatically display, unless your system requires you to enter invoice numbers manually. Default values and input parameters for invoice numbers are configurable at the system level.

Will display the relevant sales order number for invoices generated from the select for billing process flow. If the invoice is miscellaneous and was not generated by the select for billing process, then use this field for informational or reference purposes. Possible references might include sales order number or customer purchase order number.

By default, the current day's date will be entered.

By default, the current day's date will be entered.

By default, the current day's date will be entered.

Enter the customer number of the customer to be billed. The lookup feature located to the right of the field leads to a searchable customers list. You may also access this list using the keyboard shortcut . Once a customer number is entered, the customer name and billing address will display. Select the or symbol to view customer information for the specified customer. If a customer's credit is good, the button will feature a black question mark () icon. If the customer is on credit warning, the icon will turn into an orange dollar sign (). A red dollar sign () indicates the customer is on credit hold.

A valid customer number must be entered in the Customer # field before line items can be added to an invoice. If no valid customer number is entered, you will not be able to add line items to the invoice.

Enter the customer address where bills should be sent. By default, the billing address defined on the Customer master will be entered here.

Select to copy contents of billing address into the Ship-To address field. This option is enabled if the Customer master for the specified customer indicates that free-form ship-tos are allowed.

Specify the sales representative for the invoice. By default, the customer's designated sales representative will appear in the field. This field will be hidden if the enhanced commissions package is in use.

By default, the commission percentage recorded on the Customer master will be automatically entered in this field. If for some reason you select a non-default sales representative at order entry, the commission rate will not change. To adjust the commission rate, you must make the change manually. This field will be hidden if the enhanced commissions package is in use.

Specify the tax zone for the invoice. By default, the main tax zone for the customer will appear in the field. The ship-to address tax zone will be shown if a ship-to address is being used.

Specify the billing terms for the invoice. By default, the customer's standard billing terms will appear in the field.

Enter the number of the preferred ship-to address. Customers may maintain multiple ship-to addresses. If the Customer master for the specified customer indicates that free-form ship-tos are allowed, then any address may be entered. If free-form ship-tos are not allowed, then the ship-to address must be entered using the browse button located to the right of the field. The lookup feature leads to a searchable ship-to addresses list.

Enter a customer purchase order number, as needed.

Enter free on board (FOB) terms for the invoice.

The preferred ship via method for the customer will appear in the field. You may change the ship via using the list.

The Ship Via field supports free-form ship vias. If you want to enter a free-form ship via, simply type the name of the ship via into the field.

Specify the shipping charges associated with the invoice. The preferred shipping charges type for the associated sales order will appear in the field.

If your system is configured to use projects, select a project number to associate with the invoice. If the invoice was created from a sales order—and the sales order had a project number associated with it—then the project number from the originating sales order will automatically be entered here.

When you have the xTuple Project Accounting package installed—and you link a project to the invoice (or it was linked from the original sales order)—the project number will be added as the final segment of affected G/L account numbers when the invoice is posted.

Select if you want to post the invoice automatically as soon as you hit the button. If not selected, the invoice will need to be posted in another step. This option is sticky, meaning the screen will remember your choice the next time you create an invoice.

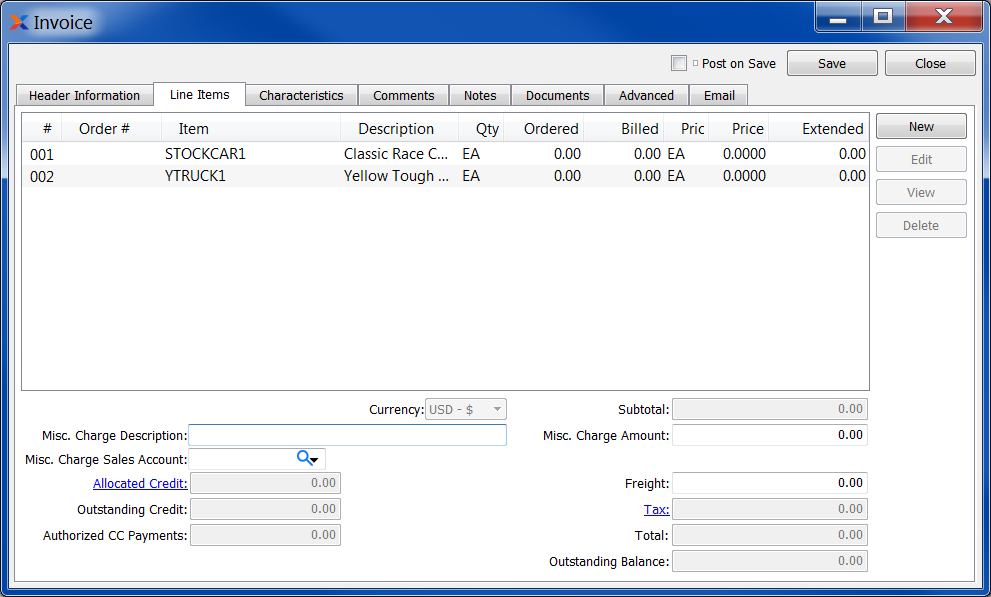

To create or modify invoice line items, select the tab at the top of the Invoice screen. The following screen will appear:

When creating or modifying invoice line items, you are presented with the following options:

Display lists line items for this invoice. A valid customer number must be entered in the Customer # field before line items can be added to the order.

Enter a description to identify the miscellaneous charge.

Enter a sales account to assign the miscellaneous charge to.

Displays the monetary value of any credit memos and/or credit card charges which have been specifically allocated to the invoice. To allocate credit memos to the invoice, select the s link.

Displays the total monetary value of all unallocated credit memos for the customer.

Displays the monetary value of any credit card pre-authorizations for the order. Credit card charges may be pre-authorized using the options found under the tab. When a credit card charge is pre-authorized, the authorization is stored and may later be posted as a completed charge using the Receivables workbench.

Displays the subtotal for the invoice line items.

Enter the amount of any miscellaneous charge. Examples of miscellaneous charges include palletization costs, co-op refund, etc. Before entering a miscellaneous charge amount, you must first assign the charge to a sales account and also enter a description of the charge.

Enter the amount of freight charge to be added to the invoice.

Tax is not calculated automatically when creating a miscellaneous invoice—as it is when an invoice is generated from a sales order. You must manually enter a tax amount if you want to add tax to a miscellaneous invoice. To get a detailed view of the tax calculation, click on the tax link using your mouse.

Displays total amount of the invoice.

Displays the open balance of the invoice, which is equal to the total minus any allocated credit memos.

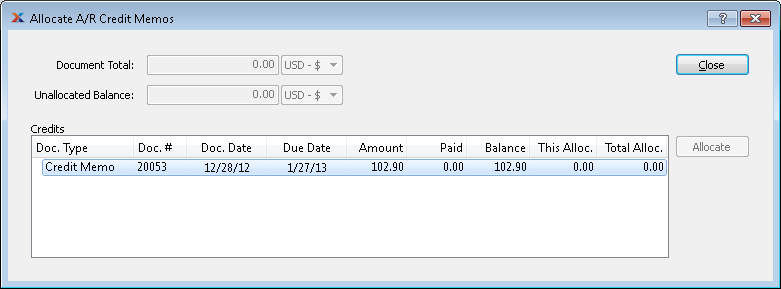

When processing sales orders or invoices, you have the option to allocate open A/R credit memos to the document. To allocate open credit memos, select the link on the tab. The following screen will appear:

When allocating credit memos, you are presented with the following options:

Displays the total amount of the document being applied to.

Displays the open balance of the document being applied to. When credit memos are allocated to the document, the open balance will go down by the amount of the allocations. The balance will go back up if those allocations are cleared.

Display lists the customer's open credit memos. When a credit memo is applied to the document, the list will indicate the relationship between the two. If the allocation is cleared, the list will update to remove the relationship.

The following buttons are unique to this screen:

Highlight a credit memo and then select this button to allocate the credit memo to the document. Partial credit memo amounts may be allocated if the document's open balance is less than the full credit memo amount.

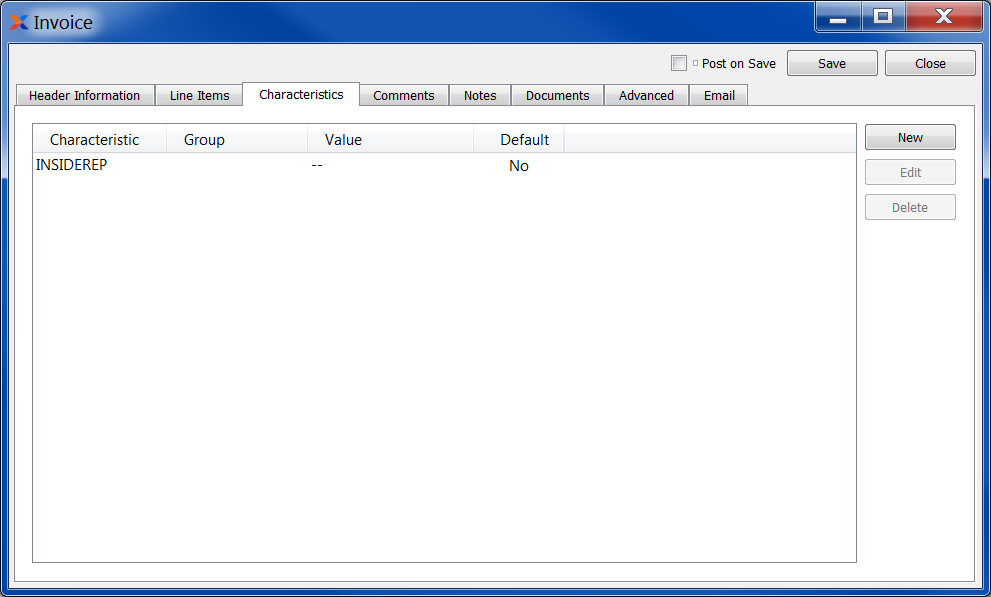

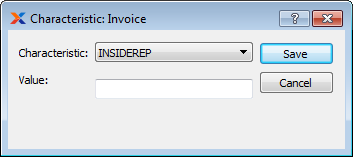

Invoice characteristics are user-defined definitions which may be used to provide additional layers of description about invoices. These descriptions are static and not processed by the system, but are useful for informational purposes. To enter characteristics associated with an invoice, select the tab. The following screen will appear:

Invoice Characteristics

To create a new characteristic for your invoice, select the button in the tab. The following screen will appear:

When creating a new characteristic, you are presented with the following options:

Select a characteristic from the list of characteristics available for your current context. To learn more about how characteristics are linked to specific contexts, please see Section 9.2.2.1, “Characteristic”.

Enter a value to associate with the characteristic.

Invoice characteristics are copied in from the sales order, miscellaneous invoices can have characteristics added in from this window.

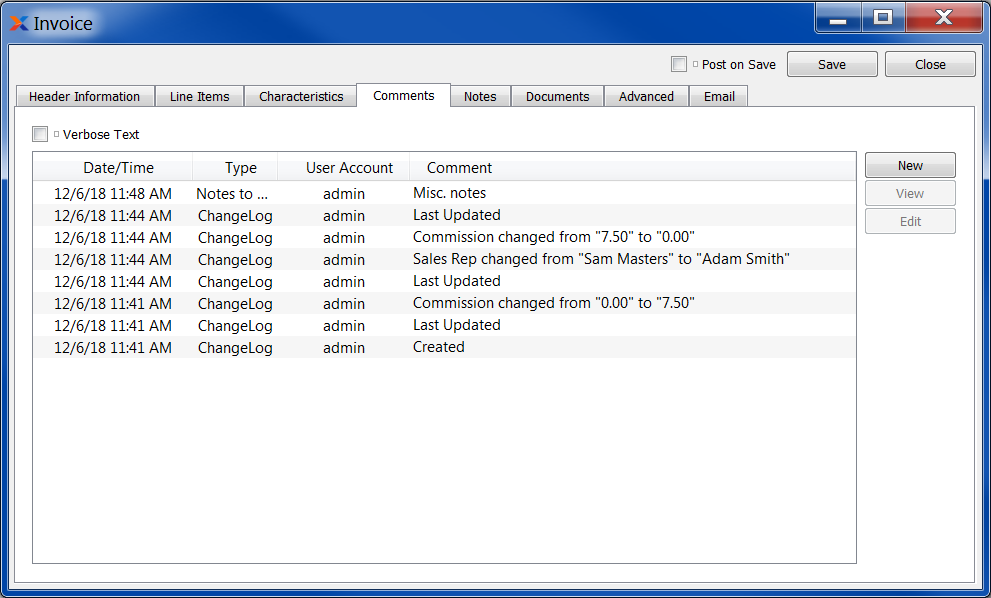

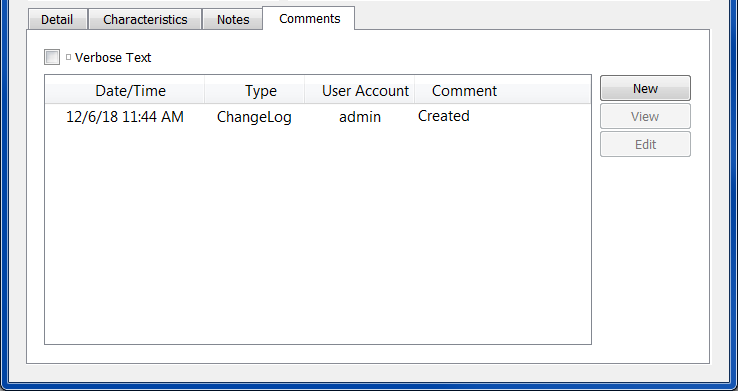

To add comments to an invoice, select the Comments tab at the top of the Invoice screen.

When adding or reviewing comments, you are presented with the following options:

Select to display all comments in the list in an expanded view which includes the entire text of each comment. To edit a comment, simply select the link next to the comment. That link will not be shown for changelog comments, which can't be edited. If the Verbose Text option is not selected, the comment list will display only header level information for each comment.

Display lists comments related to the record.

The following buttons are available:

Opens screen for creating a new comment.

Highlight a comment and then select this button to reach a read-only view of the Edit screen.

Enables you to edit highlighted comments—as long as the comments are not changelog comments. ChangeLog comments are system-generated and may not be edited. The Edit screen is the same as that for creating a new comment—except that when editing, the fields will contain comment information. Double-clicking on a comment will also bring you to the editing screen.

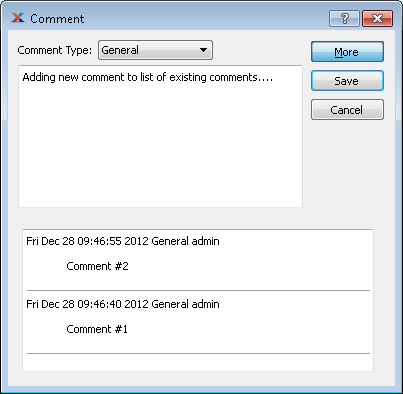

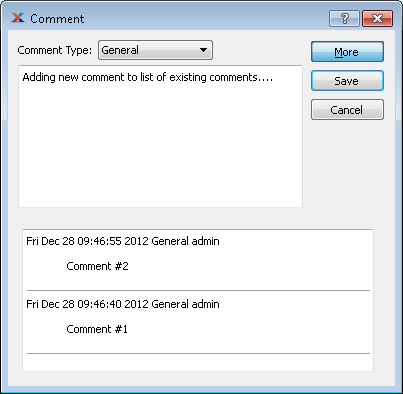

To enter a new comment, select the button. The following screen will appear:

Select a comment type from the drop-down list to classify the comment. This is a required step. Comment types may be system-defined (i.e., changelog and general) or user-defined, as described in Section 13.2.3, “Comment Types”. Once you have specified a comment type, begin typing your comment in the main text area. The text area features word-wrapping and scroll-bar support for longer comments.

The following buttons are unique to this screen:

Select to show the complete list (i.e., thread) of comments associated with the record. To hide the list, simply select the button again. The comment thread will show the most recent comment first.

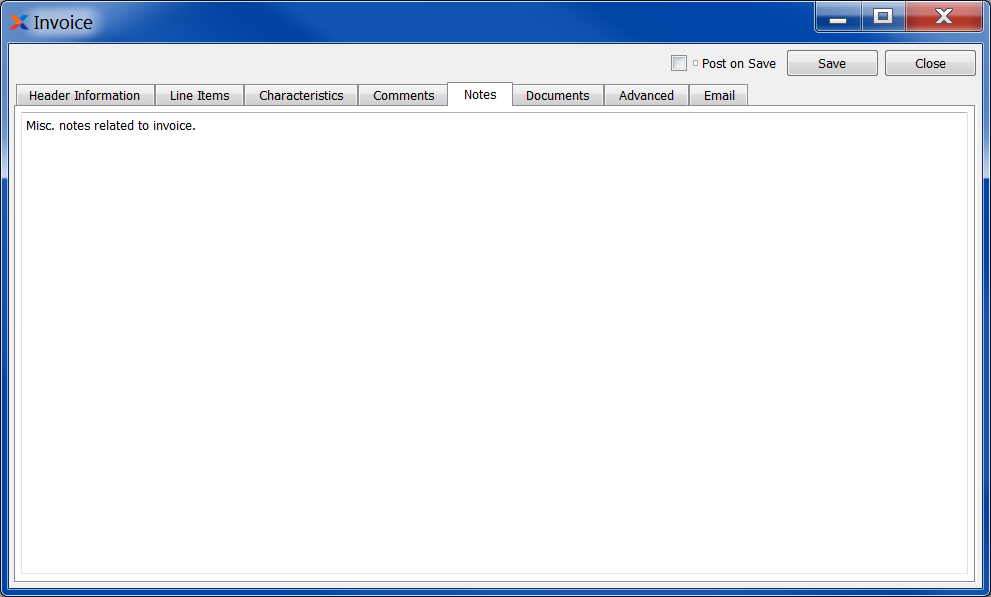

To add notes to an invoice, select the tab at the top of the Invoice screen. If the invoice was created from a sales order, any sales order notes will be transferred to the invoice. The following screen will appear:

When adding notes to an invoice, you are presented with the following options:

This is a scrolling text field with word-wrapping for entering notes related to the invoice. Notes entered on this screen will follow the invoice through the billing process. For example, you may view notes associated with a posted invoice within the invoice information report.

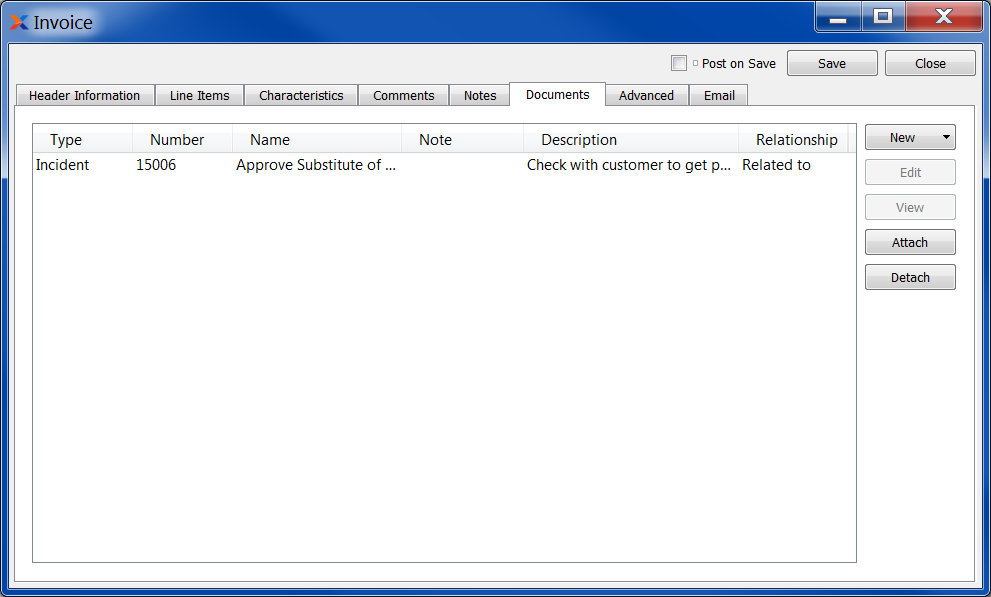

To associate documents with an invoice, select the tab. The following will be displayed:

When associating documents, you are presented with the following options:

Select to create a new document and associate it with the current record. You may create the following document types:

Select to create a new image association.

Select to create a new fixed asset association.

Select to create a new maintenance order association.

Select to create a new incident and associate it.

Select to create a new project and associate it.

Select to create a new opportunity and associate it.

Select to create a new task and associate it.

Enables you to edit associated documents. The Edit screen is the same as that for creating a new document—except that when editing, the fields will contain document information. Double-clicking on a document will also bring you to the editing screen.

Highlight a document and then select this button to reach a read-only view of the Edit screen.

Select to associate already-existing documents. The following document types may be attached: contact, account, customer, employee, file, image, incident, item, opportunity, project, purchase order, sales order, vendor, web site, work order.

Highlight a document and then select this button to remove the association.

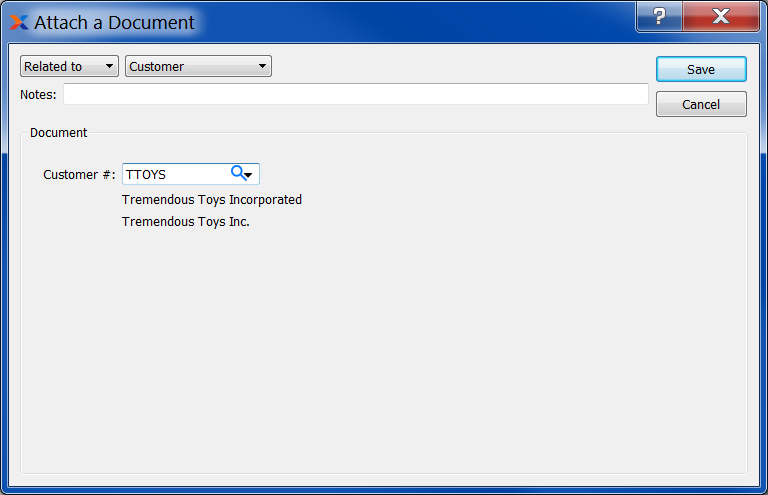

To associate already-existing documents, select the button. The following screen will appear:

When associating already-existing documents, you are presented with the following options:

Indicate how the document is related to the current record. The following relationship options are available: related to, parent of, child of, duplicate of.

Specify the kind of document you want to associate. The following document types may be attached: contact, account, customer, employee, file, image, incident, item, opportunity, project, purchase order, sales order, vendor, web site, work order. When associating files, you will also be given the option to save the file to the database.

There is no file size restriction when saving files to the database. However, excessively large files could cause storage and performance issues.

Leave any notes on the document file as needed.

Use the lookup tool to identify the specific document you want to attach. The data entry options will vary depending on the document type you select.

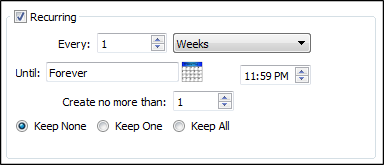

To create recurring invoices, select the tab. The following screen will appear:

When creating a recurring event, you are presented with the following options:

Check this box if you want the event to repeat itself at regular intervals, using the frequency settings you specify below. Recurring events are generated when you run the Recurring Items utility, which is described in more detail here: Section 10.2, “Create Recurring Items”.

Enter a number and select a unit of time to describe how frequently you want the event to occur. You can choose any regular schedule, ranging from once every 1 minute to once every 99 years.

Enter a date and time at which to start the first event. The default value is the time the screen opened. The From option only appears on some screens.

Enter a date and time after which the event should no longer occur.

Enter the maximum number of future copies of this event you want the system to maintain. Whenever the Create Recurring Items screen is run, it will create up to the number you enter here.

If you delete all copies of a recurring event, the event will stop repeating even if the until date has not yet been reached. xTuple recommends setting this to at least 2 to reduce the likelihood of deleting all copies of the event.

Select to make the next job catch up if work was missed.

Select to create one catch-up job if work was missed.

Select to create any missed jobs.

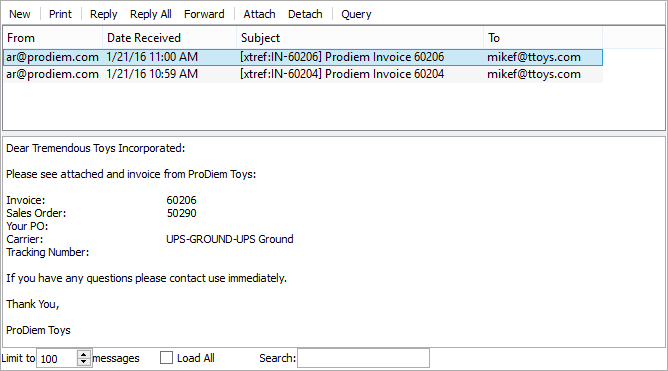

To view email associated with the invoice, select the tab. The following screen will appear:

When viewing associated emails, you are presented with the following options:

Display lists associated emails.

The content of a highlighted email will be displayed here.

Specify the maximum number of associated emails you want to be displayed in the email list. If the list is extremely long, you may experience some slowness when opening the screen.

Select to load all associated emails into the list.

Enter a string of letters or complete words to search for matches in the list of associated emails. The search will scan through subject lines, To addresses, and From addresses.

The following buttons are unique to this screen:

Select to send a new email, using the default email program on your computer.

Highlight an email and then select this button to print a copy of the email.

Highlight an email and then select this button to reply to the email's sender, using the default email program on your computer.

Highlight an email and then select this button to reply to everyone associated with the email, using the default email program on your computer.

Highlight an email and then select this button to forward the email to another person(s), using the default email program on your computer.

Highlight an email and then select this button to attach an email associated with a contact in your contact list.

Highlight an email and then select this button to remove the associated email from the list.

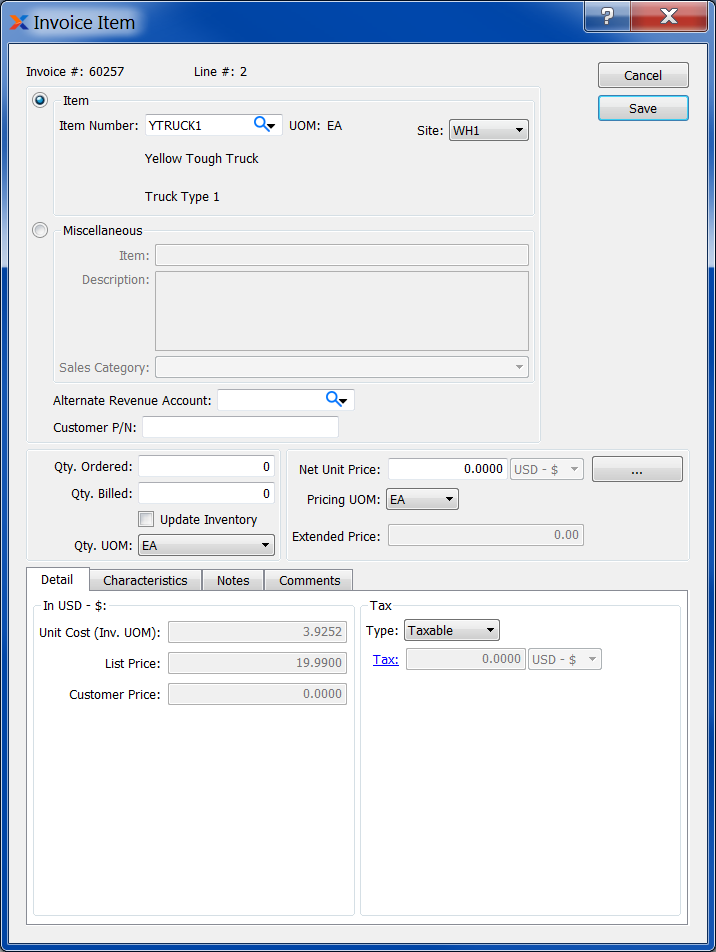

To add a new invoice line item, select the button. The following screen will appear:

When creating a new invoice line item, you are presented with the following options:

Displays the invoice number specified in the Invoice screen.

Displays the line item number for the current line item.

Indicate the item type for the invoice line item, by selecting one of the following options:

The lookup feature located to the right of the field leads to a searchable list of inventory items. The list will contain sold items available for purchase by the specified customer. The list of available items may vary from customer to customer, depending on how pricing schedules are implemented at your site. Once an item number is entered, the inventory unit of measure (UOM) and item description will automatically appear. Additionally, you may also specify the item's supplying site. Items may be supplied from multiple sites. Sites designated as sold from sites in the Item Site master for an item are considered Supplying Sites on this screen. By default, the item site with the highest ranking will be selected as the supplying site. If more than one item site share a ranking of 1, the default supplying site will be selected in alphabetical order. Item sites are ranked using the ranking mechanism on the Item Site master.

Enter a name and description for the miscellaneous, non-inventory item you are billing the customer for. The name and description fields are free-form, meaning they accept unlimited alphanumeric characters. You must also select a sales category. Sales categories are used to identify the general ledger (G/L) accounts to be used when non-inventory sales transactions take place.

Specify an alternate account to be used as the revenue account. This account will be used instead of the typical accounts pre-defined in the receivables assignments. For example, you might use this alternate account in the scenario where you are doing business with customers who are part of the same buyer's group (i.e., customer group).

If applicable, enter a customer part number to further identify the item you are billing the customer for. In the case of inventory items, the customer part number will display automatically if you enter an item alias in the Item Number field. To enter an item alias, place the cursor in the Item Number field and then use the keyboard shortcut . After you have entered a valid item alias, hit the key. A list of items that use the specified item alias will be displayed. Select the desired item from the list. The item alias will display as the customer part number. Item aliases are defined on the Item master.

Enter the quantity of the item you are billing for. The quantity ordered for inventory items is measured in the item's inventory UOM.

The quantity ordered for inventory items is based on the inventory UOM. But the price is based on the price UOM. Whenever these two UOMs are not identical, the extended price for a line item will be based on the following formula:

(Qty. Ordered) x (Price/Inv. Ratio) x (Net Unit Price)

If for some reason the prices don't look correct, check the Item master for the line item in question. It may be that the inventory and price UOMs do not exist in a 1:1 relationship.

Specify the quantity of ordered items you are billing for.

Select if you want the quantity billed to be removed from inventory when you post the invoice. If not selected, your inventory will not be updated.

Specify the UOM to be used when selling the line item. Sold items may be assigned multiple selling UOMs. These alternate UOMs may be defined on the Item master. You may also select a global conversion ratio here. Global conversions have the label Global appended to them. If a line item has no selling UOM defined, then the inventory UOM will be used here by default.

Displays the unit price for the invoice item. By default, the system will choose the lower of the following two prices: A) The most-specific pricing schedule assignment or B) any sale in effect at the time of order entry. The specificity of pricing schedule assignments is determined in the following descending order: by customer ship-to address (most specific), by customer, by customer type, by customer type pattern, by all customers. The lookup feature located to the right of the field leads to a Price List screen.

For inventory items having assigned pricing schedules, the net unit price will be automatically calculated using the information provided above. For miscellaneous items, the net unit price must be entered manually.

If your pricing schedule has multiple UOM on it (or if several pricing schedules share the same level of price specificity, but they have different UOMs) then the UOM which matches the selected UOM will be chosen—that is, as long as the quantity break does not exceed the quantity being priced. If no entry matches the UOM with a quantity break less than the quantity being priced, then the lowest value price for any UOM will be chosen. To make sure a specific UOM is always chosen at the desired level of price specificity, then your pricing schedules should include at least one UOM with a quantity break of zero.

The system can be configured to prevent users from editing the net unit price. If your system is configured that way, the Net Unit Price field will not be editable.

The price UOM is the same as the selling UOM. If an item has selling UOMs defined, then the item may be sold and priced in these alternate UOMs. You may also select a global conversion ratio here. Global conversions have the label Global appended to them. If no selling UOMs are defined, then the inventory UOM will be used here by default.

Displays the extended price. The extended price for a line item is based on the quantity ordered multiplied by the net unit price.

To view costing and tax information related to the invoice item, select the tab. You will be presented with the following options:

Displays the standard cost per unit in the item's inventory UOM.

Displays the item's list price per inventory UOM.

Displays the price (per inventory UOM) given to the specified customer for the specified item. Special customer prices can be set for individual customers or customer groups by using a pricing schedule.

The following tax-related information is available:

Specify the tax type for the invoice item. If the Item master does not have a tax type for the invoice's tax authority, then no tax will be charged.

Displays the amount of tax to be charged for the invoice line item quantity. To get a detailed view of the tax calculation, click on the link using your mouse.

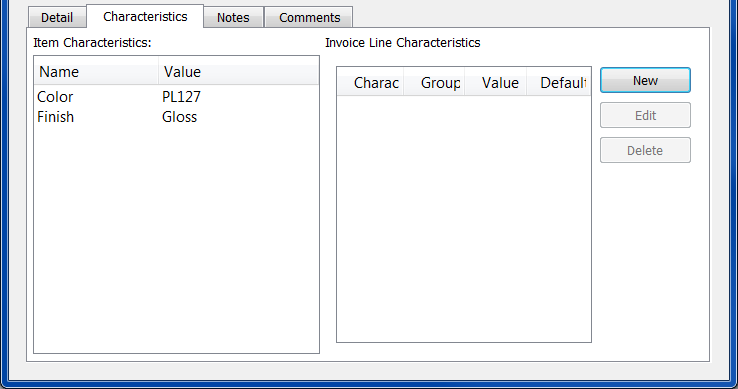

Characteristics for an invoice item can be added from the Characteristics tab.

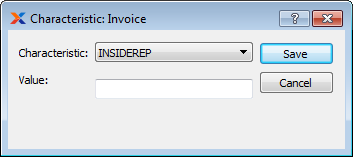

To create a new characteristic for the invoice item, select the button from the characteristics list. The following screen will appear:

When creating a new characteristic, you are presented with the following options:

Select a characteristic from the list of characteristics available for your current context. To learn more about how characteristics are linked to specific contexts, please see Section 9.2.2.1, “Characteristic”.

Enter a value to associate with the characteristic.

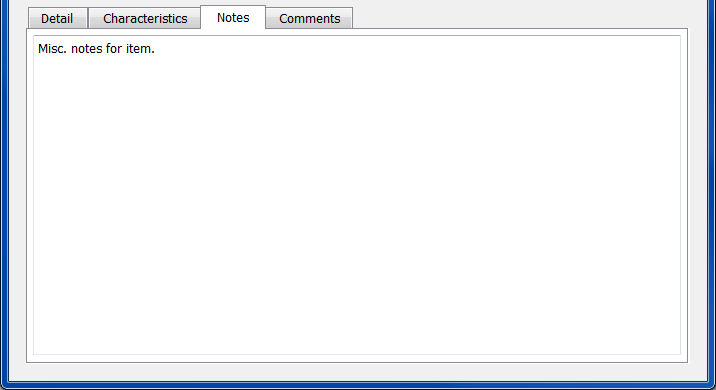

To add notes to an invoice line item, select the tab at the bottom of the screen. If the invoice was created from a sales order, any sales order line item notes will be transferred to the invoice. The following screen will appear:

When entering invoice line item notes, you are presented with the following options:

This is a scrolling text field with word-wrapping for entering general notes related to the invoice item.

To add comments to an invoice line item, select the tab. If the invoice was created from a sales order, any comments on the sales order line item will be transferred to the invoice.

When adding or reviewing comments, you are presented with the following options:

Select to display all comments in the list in an expanded view which includes the entire text of each comment. To edit a comment, simply select the link next to the comment. That link will not be shown for changelog comments, which can't be edited. If the Verbose Text option is not selected, the comment list will display only header level information for each comment.

Display lists comments related to the record.

The following buttons are available:

Opens screen for creating a new comment.

Highlight a comment and then select this button to reach a read-only view of the Edit screen.

Enables you to edit highlighted comments—as long as the comments are not changelog comments. ChangeLog comments are system-generated and may not be edited. The Edit screen is the same as that for creating a new comment—except that when editing, the fields will contain comment information. Double-clicking on a comment will also bring you to the editing screen.

To enter a new comment, select the button. The following screen will appear:

Select a comment type from the drop-down list to classify the comment. This is a required step. Comment types may be system-defined (i.e., changelog and general) or user-defined, as described in Section 13.2.3, “Comment Types”. Once you have specified a comment type, begin typing your comment in the main text area. The text area features word-wrapping and scroll-bar support for longer comments.

The following buttons are unique to this screen:

Select to show the complete list (i.e., thread) of comments associated with the record. To hide the list, simply select the button again. The comment thread will show the most recent comment first.