|

xTuple ERP Reference Guide |

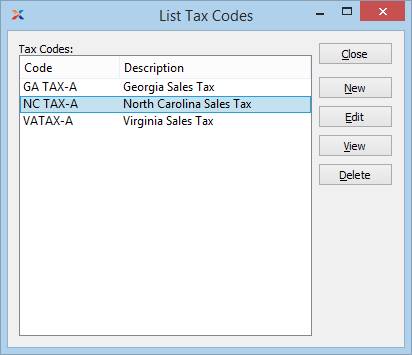

Tax Codes define the amount and type(s) of Tax to be added to an Order. To access the master list of Tax Codes, select the "Tax Codes" option. The following screen will appear:

The Tax Codes master list displays the code and description for all existing Tax Codes.

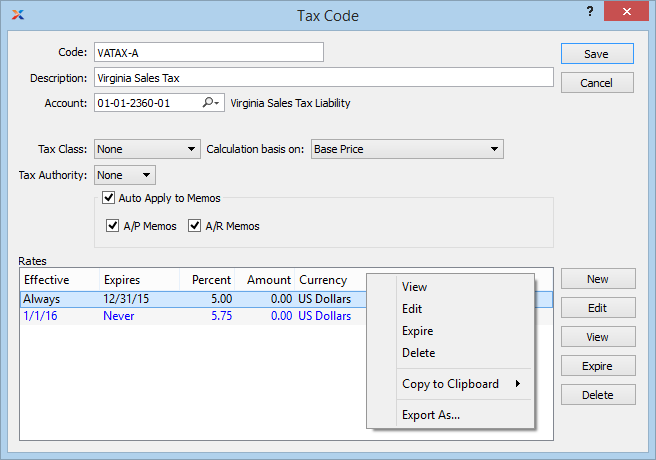

To create a new Tax Code, select the NEW button. The following screen will appear:

When creating a new Tax Code, you are presented with the following options:

Enter an identifying code for the Tax Code.

Enter a description to identify the Tax Code.

Specify a valid General Ledger Account. This is a Liability Account. It will be credited when Invoices are posted and debited when Credit Memos are posted.

When cash based tax distribution is used, a Clearing Account as well as a Distribution Account can be specified. Tax related transactions are posted to the Clearing Account when cash related transactions are posted.

Select a valid Tax Class.

Select a valid calculation basis. This list includes "Base Price" and all other Tax Codes that share the same Tax Class. When "Base Price" is selected the Tax Code may be assigned on the Tax Assignment window, and the tax calculation will be based on the base price amount to be taxed, plus any applicable cumulative taxes. When a Tax Code is selected, then the Tax Code will be calculated against the derived amount from the referenced Tax Code. This is a method used for defining nested taxes or "a tax on a tax".

Select a valid Tax Authority. This selection is required if you want to generate Tax Returns for a specified Tax Authority. The link between Tax Codes and Tax Authorities is the key driver behind the Tax Return report.

For transaction information to be included in the Tax Return report, the Tax Authority must be linked to one or more Tax Codes.

Select if you want the Tax Code rate to be automatically applied to miscellaneous Credit/Debit Memos. This feature is designed primarily to support Value Added Tax (VAT) scenarios. If this option is not selected, Tax will not be calculated automatically for Memos.

Select to have the Tax Code rate automatically applied to miscellaneous Payables Credit/Debit Memos.

Select to have the Tax Code rate automatically applied to miscellaneous Receivables Credit/Debit Memos.

When defining or maintaining Tax Code Rates, you are presented with the following options:

The following buttons are unique to this screen:

Highlight a Tax Code Rate and then select this button to expire the Rate. The Effectivity End Date will be changed to the current date.

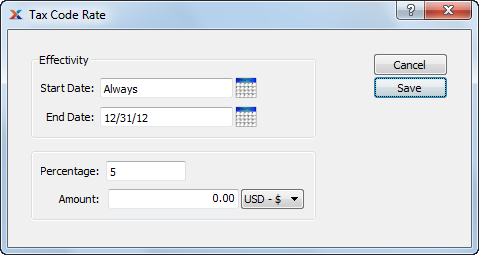

To create a new Tax Code Rate, select the NEW button. The following screen will appear:

When creating a new Tax Code Rate, you are presented with the following options:

Enter the date that this Tax Code Rate becomes effective.

Enter the date that this Tax Code Rate is no longer effective.

Enter the tax rate as a percentage.

Enter the additional flat rate amount.