|

xTuple ERP Reference Guide |

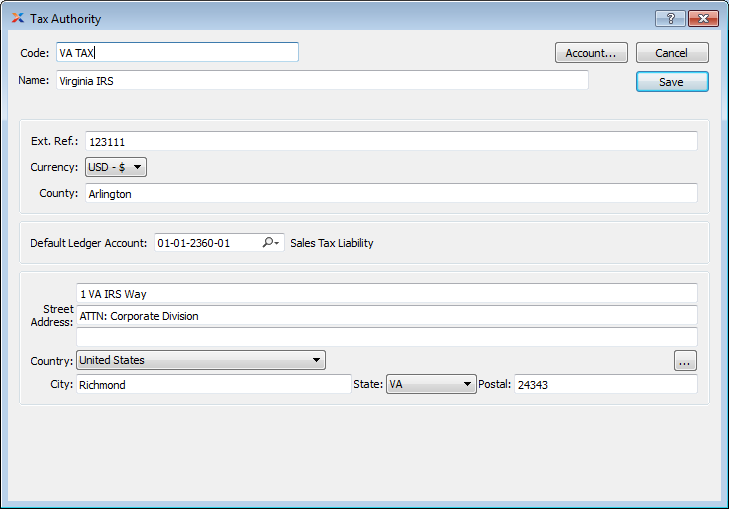

To create a new Tax Authority, select the NEW button. The following screen will appear:

When creating a new Tax Authority, you are presented with the following options:

Enter a code to identify the Tax Authority.

Enter a name to describe the Tax Authority.

Use this field to record any external accounting references for the Tax Authority—if applicable.

Specify the Currency to be used for Tax calculations when transactions are governed by the Tax Authority.

The Currency selection affects only Tax calculations for transactions governed by the Tax Authority. It has no impact on the Currency used for Line Items, etc. on an Order. If the Tax Authority requires Tax to be collected in the base Currency, then do not make a selection; leave this field blank. This option won"t even be available if your site does not have multiple Currencies defined.

If a Tax Authority collects Tax in your base Currency, then leave the Currency selection blank.

Enter the County which the Tax Authority has jurisdiction over—if applicable.

Specify the G/L Account to credit when payment (check) to Tax Authority is posted.

Manually enter Tax Authority's Address information in the fields below—or use the lookup feature to select pre-existing Address information. If a new Address is manually entered here, that Address will be added automatically to the master list of Addresses. For additional documentation related to creating Addresses, see Section 8.1, “ New Address”.

The following buttons are unique to this screen:

Select to open the Tax Authority's Account.