|

xTuple ERP Reference Guide |

Sales Categories are used to identify the General Ledger (G/L) Accounts to be used when processing the following:

Non-Inventory Invoices

Receivables Credit Memos (optional)

Receivables Debit Memos (optional)

Cash Receipts (optional)

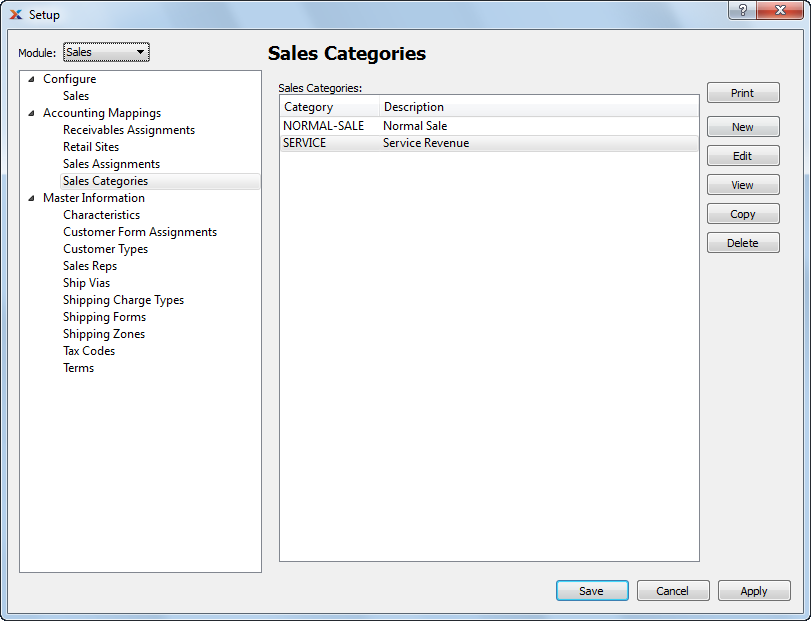

For example, when creating an Invoice for miscellaneous goods or services unrelated to Inventory, you must select a Sales Category—thereby identifying the G/L Accounts the sales transaction will be distributed to. To access the Sales Categories master list, select the "Sales Categories" option. The following screen will appear:

The "Sales Categories" screen displays information on existing Sales Categories.

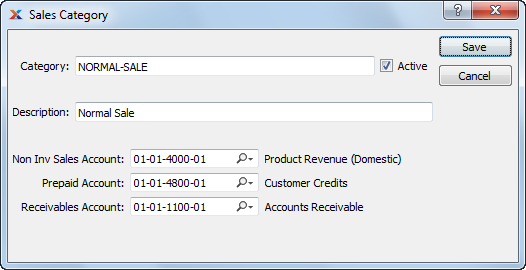

To create a new Sales Category, select the NEW button. The following screen will appear:

When creating a new Sales Category, you are presented with the following options:

Enter an identifying code for the Sales Category.

Select if the Sales Category is currently active. Not selecting means the Sales Category is inactive.

Enter a description to identify the Sales Category.

Identify a General Ledger (G/L) Account to distribute Sales Revenue to for non-Inventory Items. This is a Revenue Account. It will be credited when Invoices for Non-Inventory goods are posted.

Specify a General Ledger (G/L) Account to use for handling prepaid Receivables. This is a Revenue contra Account. If a Sales Category is used when entering a Miscellaneous Receivables Credit Memo, this Account will be debited when the Credit Memo is posted. If used when entering a Miscellaneous Receivables Debit Memo, the Account will be credited when the Debit Memos are posted.

Specify a General Ledger (G/L) Account to use for handling Customer deposits. This is an Asset Account. If a Sales Category is used when applying a Cash Receipt to a Customer Invoice, this Account will be credited when the Cash Receipt is posted.