|

Fixed Assets Product Guide |

Depreciation is first calculated as an unposted transaction, unless immediate posting has been specified. To learn more, go to the following menu: .

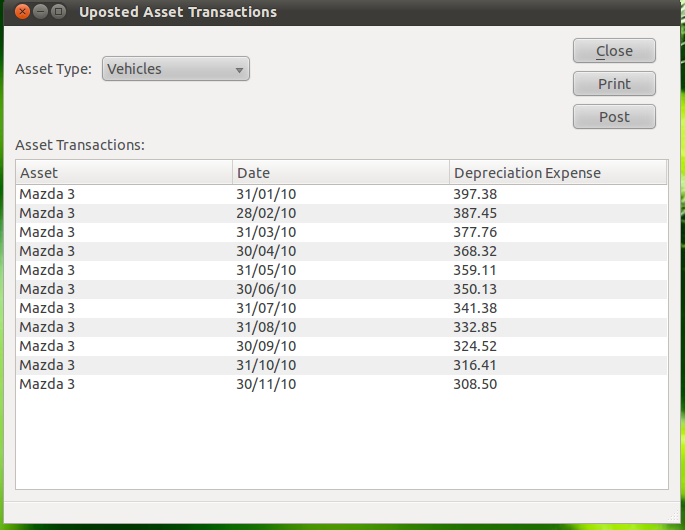

The Unposted Asset Transactions screen displays all generated depreciation transactions that have not yet been posted to the general ledger. From this screen, you can review the transactions that have been created and then decide how to proceed with them.

To post unposted transactions, follow these steps:

Select the asset type whose asset transactions you want to post.

Review the transactions.

If satisfied with the transactions in the list, select the button. This will post the displayed depreciation transactions for the selected asset type only.

Posted transactions result in the following ledger entries:

Debit – depreciation expense

Credit – accumulated depreciation

Depreciation in the ledger is grouped by asset type. You will not see the individual asset depreciation in the ledger.

To delete a depreciation calculation, right-click on the desired transaction and select from the menu.

Depreciation is calculated from the last-generated transaction date. If you delete entries prior to the last-generated date, you cannot recreate these entries. This functionality is to allow you to create historically-installed assets that might already have had depreciation factored in the general ledger.