|

Fixed Assets Product Guide |

The first method for creating fixed assets was covered in the previous chapter and involves the direct creation of a new fixed asset in the Asset screen. This method does not post any financial transactions to the appropriate accounts payable or general ledger accounts, nor does it update your financial asset register.

The second method of creating a fixed asset is to purchase the asset. This transaction creates the asset and generates financial transactions depending on the method of purchase. To gain the full benefit of the depreciation package and its integration with the general ledger you should use this method to create new assets.

To learn more, go to the following menu: .

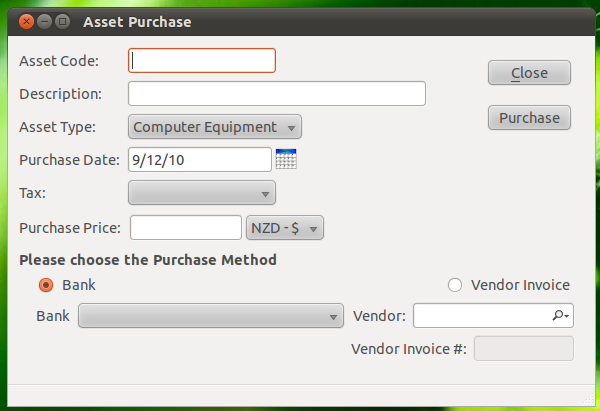

When entering an asset purchase, most fields are mandatory. Here are the steps to follow:

Enter the asset code, description and asset type.

Enter the purchase date. This date determines the distribution date for financial transactions.

If tax is applicable, select the tax zone and the tax type.

Enter the purchase price of the asset excluding the selected taxes. Tax will be added to this amount as appropriate.