|

xTuple ERP Reference Guide |

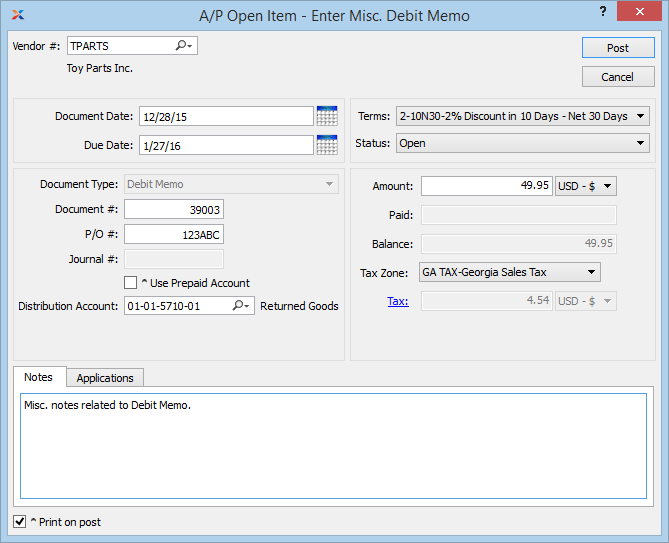

A miscellaneous debit memo is like a voucher—the main difference being that a miscellaneous debit memo is not necessarily linked to a purchase order. To enter a miscellaneous debit memo, go to . The following screen will appear:

When entering a miscellaneous debit memo, you are presented with the following options:

Enter the vendor number of the vendor you want to enter a miscellaneous debit memo for.

Specify a date to associate with the miscellaneous debit memo.

Displays the due date for the miscellaneous debit memo.

Displays the document type, namely Debit Memo.

Displays the next available miscellaneous debit memo number.

The value for the next available debit memo number can be configured at the system level.

Enter a purchase order number to associate with the credit memo. You may leave this field blank if you do not want to enter an associated purchase order number.

Displays the journal number if any amount has been applied.

If you select this option, the default prepaid account defined for the vendor type under the payables assignments will be used.

Specify an alternate account to use in place of the default prepaid account. Note that you will have to manually type in the account number to the alternate account. A message box will come up asking, "This account is not normally used here, are you sure?", click .

By default, the terms defined on the Vendor master for the specified vendor will be used here.

Choose from the following status options:

Select to allow normal processing for the open payable. If open items are placed on hold, they may not be selected for payment. You can put open items on hold using the right-click menus on several screens, including the Payables workbench. Once an open item is closed, it cannot be reopened.

Select to place the open payable on hold. If open items are on hold, they may not be selected for payment. You can take open items off hold using the right-click menus on several screens, including the Payables workbench. Once an open item is closed, it cannot be reopened.

Specify the amount of the miscellaneous debit memo.

Displays the amount applied to date for the miscellaneous debit memo.

Displays the remaining amount still available to apply for the miscellaneous debit memo.

Displays the tax zone associated with the specified vendor.

Tax will be calculated automatically if the associated tax code is configured to calculate tax on memos. You can link a tax code to memos with a tax assignment that matches the tax code, the tax zone, and the system-defined Adjustment tax type. To manually enter tax, select the blue link which serves as the label for this field. If tax is entered manually, the amount will be charged to the general ledger account for the relevant tax code.

This is a scrolling text field with word-wrapping for entering notes related to the miscellaneous debit memo.

Select if you want to print a copy of the debit memo after the button is selected. Debit memos may also be reprinted from, among other places, the Vendor screen.

If the vendor specified on the debit memo has an EDI profile attached, you may encounter an EDI processing interface when printing it.

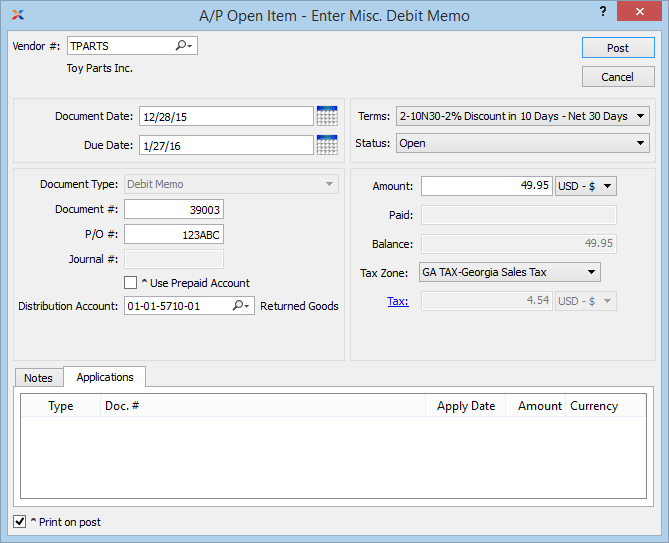

To view applications, select the tab at the bottom of the screen. The following screen will appear:

Display lists the history of applications related to the miscellaneous debit memo, if any.