|

xTuple ERP Reference Guide |

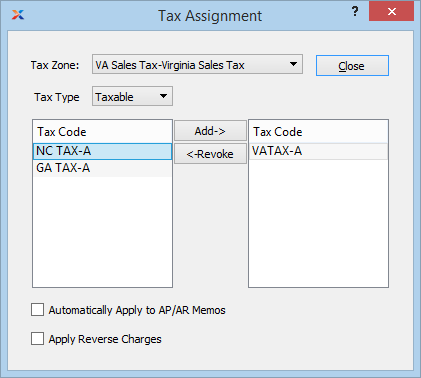

To create a new Tax Assignment, select the NEW button. The following screen will appear:

When creating a new Tax Assignment, you are presented with the following options:

Specify the Tax Zone you want to associate with the Tax Assignment. If you select the "Any" option, this means any defined Tax Zone is a possible match.

Specify the Tax Type you want to associate with the Tax Assignment. If you select the "Any" option, this means any defined Tax Type is a possible match.

Use the ADD-> and <-REVOKE buttons to specify the Tax Codes you want to associate with the Tax Assignment.

Select if you want linked Tax Code rate(s) to be automatically applied to miscellaneous Credit/Debit Memos. This feature is designed primarily to support Value Added Tax (VAT) scenarios. If this option is not selected, Tax will not be calculated automatically for Memos.

Select if you want reverse charges to be applied. This feature is designed primarily to support Value Added Tax (VAT) scenarios. For example, a VAT-registered company in the United Kingdom buys supplies from a VAT-registered company in a different European country. In this scenario, a double entry has to be created for debit and credit so that VAT ends up being zero.