|

xTuple ERP Reference Guide |

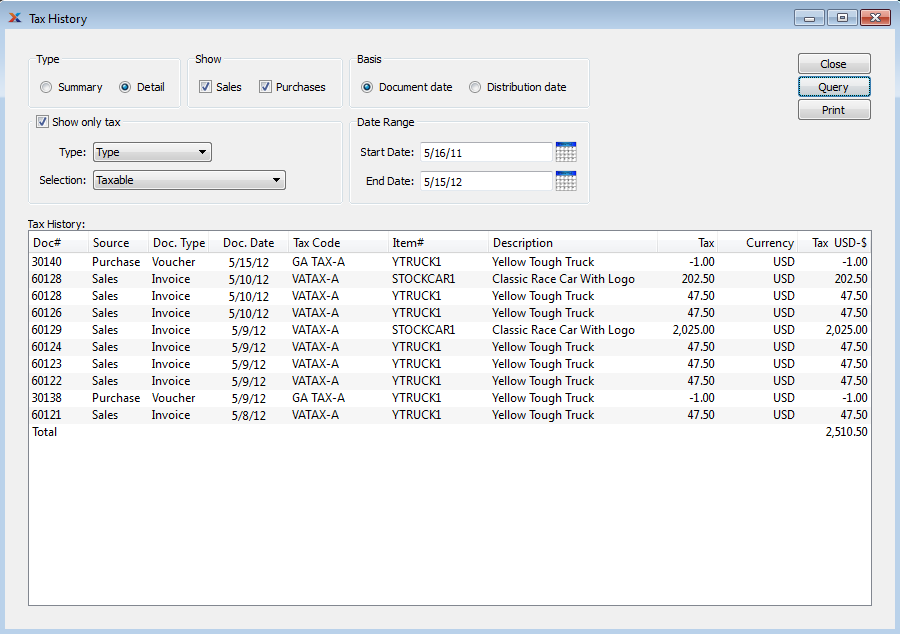

The Tax history report offers you the ability to view summarized or detailed information about both sales and purchase Tax history. This report will be especially useful for those who both collect and pay VAT taxes—and must report on and pay net VAT taxes collected. The netting column will only be visible when both the "Sales" and "Purchases" options are selected. To view Tax history, select the "Tax History" option. The following screen will appear:

When displaying Tax history, you are presented with the following options:

Specify one of the following options for viewing your Tax history:

Select to display a summarized view of your Tax history.

In summary mode, you may select from the following filter options:

Select to show summarized Tax information based on one of the following types of information: Tax Code, Tax Type, Tax Class, Tax Authority, or Tax Zone.

Specify a selection option to further refine your results. The selection options will vary depending on the type chosen. For example, if you choose "Zone," then you will be able to choose from a list of all your defined Tax Zones.

Select to display a detailed view of your Tax history.

In detail mode, you may select from the following filter options:

Select to show detailed Tax information based on one of the following types of information: Tax Code, Tax Type, Tax Class, Tax Authority, or Tax Zone.

Specify a selection option to further refine your results. The selection options will vary depending on the type chosen. For example, if you choose "Zone," then you will be able to choose from a list of all your defined Tax Zones.

Specify the kind(s) of Tax you want to display. If both options are selected, the report will automatically include the net balance between sales Tax paid and purchase Tax collected.

Select to include sales Tax in the report. When this option is selected, the columns in the report will include sales information. If not selected, those column headers will be hidden.

Select to include Tax on purchases in the report. When this option is selected, the columns in the report will include purchase information. If not selected, those column headers will be hidden.

Specify a date basis to use for the report:

Select to use the document date as the basis for the report.

Select to use the G/L distribution date as the basis for the report.

Specify the date range, based on the chosen date basis:

Taxes posted on and after this date will be included in the report.

Taxes posted on and before this date will be included in the report.

Display lists Tax history, using the specified parameters.

When cash based tax distribution is used, tax related transactions posted to the Clearing Account are joined with tax history entries.