|

xTupleCommerce Product Guide |

Tax regions, along with the maximum tax zone setting, are needed to assign appropriate taxes to guest users. These features do not apply to regular customers, whose tax zone information should already be defined in the ERP.

The goal of tax regions is to identify a tax zone based on the address information supplied by the guest user. If no matching region is found, then the user will be assigned to the maximum tax zone, which is defined on the xDruple Integration screen. Both these features—tax regions and the maximum tax zone—help ensure you are collecting sufficient taxes when guest orders are placed on your portal. For more information about the maximum tax zone, please see Section 12, “Configure xDruple Integration”.

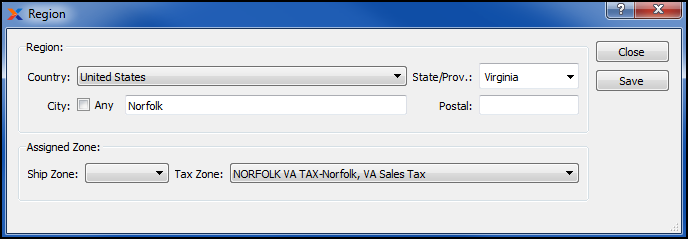

To set up a new tax region, go to . Before proceeding, make sure your user has the privilege(s) to access tax regions. You are free to define as many (or as few) tax regions as you want. Regions can be either general or specific, depending on your needs. For example, you could define a region to cover an entire country. Addresses matching that region/country would inherit the tax zone defined for that region. Conversely, individual cities or states might have their own region, with matching addresses likewise inheriting those corresponding tax zones. The following screenshot shows the Region screen:

Tax region setup

When defining a region, you are presented with the following options:

Specify the address parameters you want the region to match.

Specify the country to match for the region. To match the entire world in one region, choose the option.

Specify the city to match for the region. The option will match all cities.

Specify the state or province to match for the region. The option will match all states and provinces.

This feature is not currently supported.

Indicate the tax zone you want matching addresses to be assigned to. The tax zone is needed to correctly estimate tax for the user's order.

This feature is not currently supported.

Select a tax zone from the list of available tax zones. Tax zones are defined in the ERP.

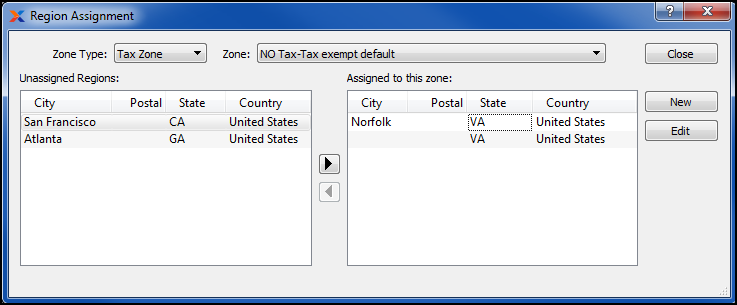

The tax regions feature also comes with a Region Assignment screen, where you can view and also manage your tax region assignments. To begin defining tax region assignments, go to . The following screenshot will appear:

Region Assignment

To learn more about setting up taxes in the ERP, read this article on Tax Basics.