|

Fixed Assets Product Guide |

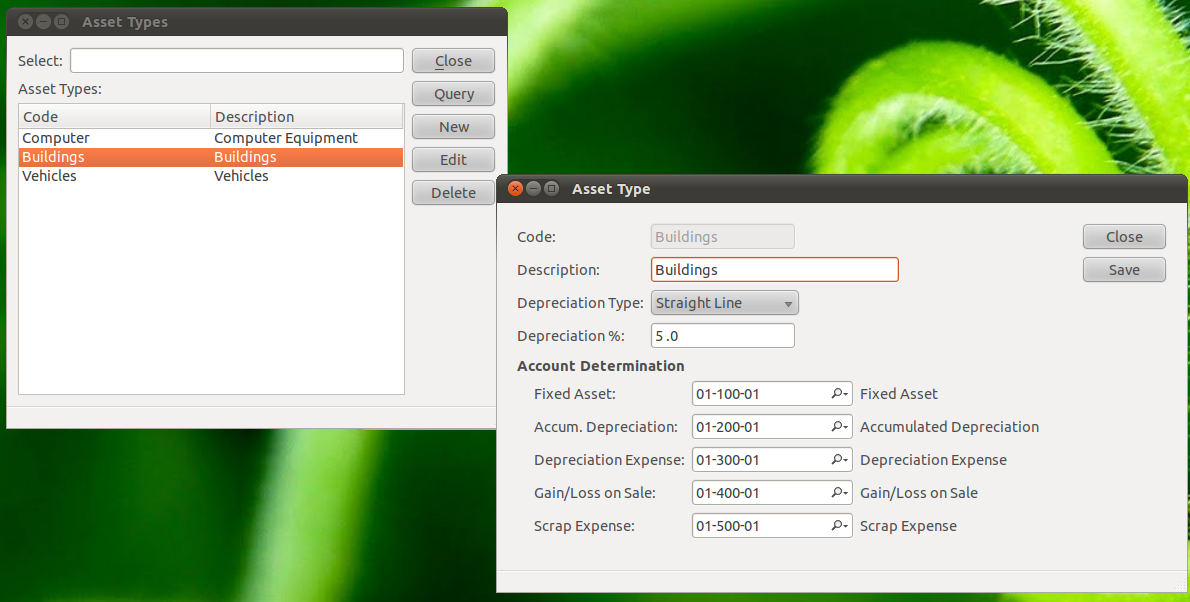

Asset types (alternately known as asset classes) are used to group assets together. Asset types are used to define the depreciation method and depreciation percentage. An asset type also stores information about the general ledger accounts where asset transactions will be posted to.

To locate fixed asset types, go to the following menu: .

From the asset types screen, follow these steps to get started:

Press to create a new asset type.

Enter in the asset type code and description.

As of version 1.2.0, the Fixed Asset package no longer requires mandatory depreciation and ledger accounts if the depreciation package has not been installed.

Choose an appropriate depreciation method: No Depreciation, Straight Line, or Diminishing Value. These depreciation methods also come in monthly or annual frequencies.

Next, choose an appropriate depreciation percentage for this class of assets. For diminishing value the percentage is mandatory. For straight line, if you do not choose a depreciation percentage the percentage will be calculated for each asset based on its asset cost and asset life.

Enter in the ledger accounts. All accounts are mandatory.

Save the asset type.